Core Portfolios

Automated investment management

Core Portfolios makes investing easier. Our team of professionals paired with automated technology takes care of the day-to-day investing, keeping you on track. If your goals ever change, it’s easy to adjust your strategy. Plus, you can use tax-loss harvesting to potentially lower your tax bill.

Decided a managed portfolio is right for you?

Open yours in a few easy steps.

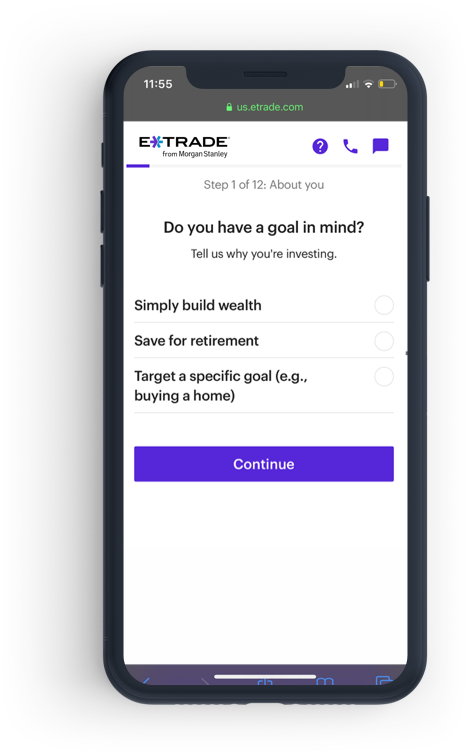

Customized to you

Create a plan that fits your goals. Tell us where you’d like to be, and we’ll do the rest. Your investment strategy can be customized with socially responsible investments and more.

Built to help

you reach your goals

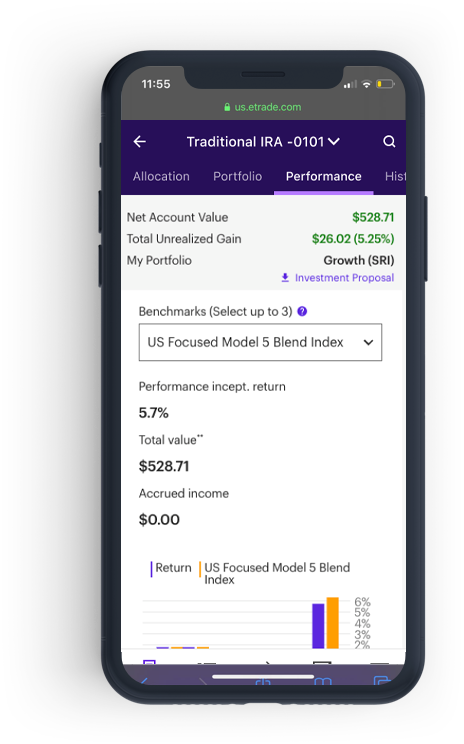

We'll build a diversified portfolio with investments that are handpicked by our team of experts and that seek to provide optimal returns based on your goals and risk tolerance. Our advanced technology then monitors and automatically updates your portfolio to keep your goals on track.

Sit back and

let us do the work

We’re hands on so you can be hands off. Track your progress online anytime or through monthly reports. And if your goals change, we can easily adjust your investment strategy.

Customized to you

Create a plan that fits your goals. Tell us where you’d like to be, and we’ll do the rest. Your investment strategy can be customized with socially responsible investments and more.

Built to help

you reach your goals

We'll build a diversified portfolio with investments that are handpicked by our team of experts and that seek to provide optimal returns based on your goals and risk tolerance. Our advanced technology then monitors and automatically updates your portfolio to keep your goals on track.

Sit back and

let us do the work

We’re hands on so you can be hands off. Track your progress online anytime or through monthly reports. And if your goals change, we can easily adjust your investment strategy.

Put your money to work today

Pay as low as $1.50 or 0.30% annually. All you need is $500 to get started!1

Enter an investment amount to calculate the annual advisory fee

Minimum investment: $500

*Based on 0.30% of assets1

What you get with Core Portfolios

Please note that while Core Portfolios does the investing on your behalf, it cannot tell you whether a managed account is right for you.

Read our article to see if Core Portfolios is right for youkeyboard_arrow_right

A customized portfolio

We’ll help you with an investment strategy that has the potential to grow with you.

Monitored to keep you on track

We’ll track your investments every day and rebalance to help meet your goals.

Help whenever you need it

We are always on hand to give you any support you may need.

A long-term investing strategy

We'll help you reach your goals with a diversified portfolio that stays aligned with your preferred risk tolerance.

Tax-smart investing

Tax-loss harvesting can potentially lower your capital gains taxes.

FAQs

Which account types are eligible for Core Portfolios?

Most retail E*TRADE from Morgan Stanley brokerage and retirement accounts with a US address can enroll in Core Portfolios. Eligible accounts include:

Brokerage:

- Individual

- Joint

- Custodial

Retirement:

- Rollover IRA

- Traditional IRA

- Roth IRA

SEP IRA:

Please note the program is not available for trusts, charitable organizations, corporations, institutional and business accounts.

What criteria do you use to select investments for a portfolio?

For each asset class (such as equities or fixed income), MSSB selects investment holdings that, when combined in broad-based asset allocation strategies, seek to provide a high level of return potential for a given level of risk over the long term, generally three years or longer. That’s called risk-adjusted return potential.

Each investment selection is made by analyzing a spectrum of key data points, including but not limited to historical performance, expenses, tracking error, and liquidity. MSSB leverages the work of the Morgan Stanley Global Investment Managers Analysis group in creating opinions on ETFs held in your Core Portfolios account. Portfolio holdings are monitored regularly and replaced as necessary.

How do I fund my Core Portfolios account?

New clients (External transfer)

You can fund your account by making a cash deposit or transferring securities. Securities transferred to fund an account will generally be liquidated upon receipt. We can accept certain types of securities for deposit at our discretion. Please note that this could result in a taxable event.

Existing clients (Internal transfer)

You can fund your account using cash or existing securities. Securities transferred to fund an account will generally be liquidated upon receipt. We can accept certain types of securities for deposit at our discretion. The intra-firm transfer tool on the Move Money page will allow you to easily transfer a portion or the full value of an existing account into a new Core Portfolios account. As an added benefit, all transactions will be processed commission-free and the proceeds will be used to fund your recommended portfolio. Please note that this could result in a taxable event.

How do I get started?

Step 1: Complete an investor profile questionnaire and suitability application

Answer a short series of questions about your investment objectives, time horizon, and risk tolerance that will help us make an investment recommendation.

Step 2: Customize your portfolio

You can further personalize your portfolio with additional investment strategies like socially responsible (SRI and ESG) and smart beta ETF investments.

Step 3: Review your recommended portfolio

We will then present you with an investment proposal in which we recommend an investment strategy based on the results of your investor profile questionnaire. You may choose to accept our recommendation or select a different investment strategy for your account by retaking the investor profile questionnaire. You will have to attest to your new investment objective and risk tolerance needs to align with the new portfolio you chose.

Step 4: Implement your plan

Open and fund your Core Portfolios account.

How are investments managed?

Here’s how the investments are managed:

- The Investment Solutions Investment Committee (ISIC) utilizes. an investment analysis methodology that incorporates various quantitative criteria, including historical return, risk, expenses, manager tenure, performance and style consistency, and asset size and growth, to select securities held in the investment portfolios.

- MSSB uses a systematic algorithm to determine your recommended portfolio of ETFs based on answers to your Investor Profile Questionnaire. The goal is to select the appropriate investment portfolio based on an investor’s investment objectives risk tolerance, and time horizon.

- Core Portfolios is checked daily for opportunities to rebalance. If your portfolio drifts too far, generally by 5% or more, from your target allocation and when material deposits or withdrawals are made, our portfolio management team will automatically rebalance your investments to help keep the account on track.

- Access to a dedicated support team is just a phone call away. For any questions about the Core Portfolios program, please call the Core Portfolios support team available weekdays from 8:30 a.m. to 8:30 p.m. ET at 1(866)-484-3658.

For additional information, please see the MS Core Portfolios ADV Brochure.

What is the investing approach of MSWM?

MSSB follows a disciplined investment strategy based on principles of Modern Portfolio Theory (MPT). MPT is a widely utilized framework for building diversified investment portfolios. The underlying philosophy of MPT is to contrast a portfolio with a combination of asset classes (e.g., US equity, international equity, fixed income) based on the expected returns and volatility that these asset classes have displayed over time.

Combining different asset classes may help limit risk and increase returns of the investment portfolio as the classes have varying levels of correlation to one other. Many of the assumptions made in MPT rely on historical data, which may not be representative of the future, potentially leading to unexpected outcomes. All portfolio holdings will be selected by E*TRADE Capital Management's investment strategy team based on multi-stage due diligence by Global Investment Committee.

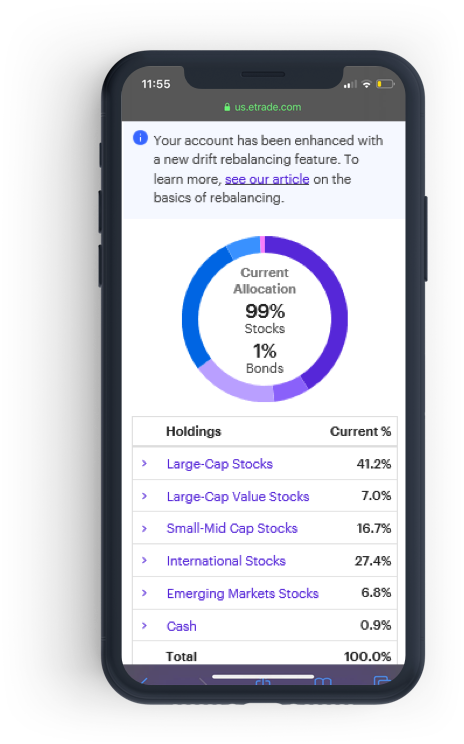

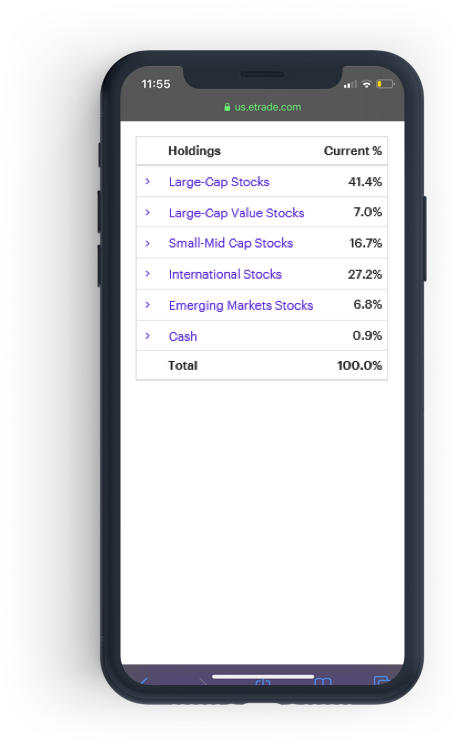

What is portfolio rebalancing?

When markets fluctuate, it’s easy for your portfolio to drift from its original target allocation. That’s why we monitor your Core Portfolios account daily to see if it needs to be rebalanced. Whenever the investments in your portfolio drift too far, generally by 5% or more, from the weighted percentage of the portfolio’s target asset allocation, our portfolio management team will automatically rebalance your investments to maintain the appropriate risk level aligned with the Investment Strategy that you have selected. Read our educational article to learn more about portfolio rebalancing and how it can benefit you.

How does MSSB choose which investments to sell when a client withdraws funds?

We first seek to use the cash balance in the account to satisfy the withdrawal. Then, if the client needs additional cash, we strategically sell investments from across the portfolio in an effort to maintain the portfolio’s target asset allocation.

How can I further personalize my Core Portfolios account?

Once you have selected your portfolio, you can further customize your strategy based on your investing preferences.

Core Portfolios (Smart Beta): Want a more active portfolio strategy? We’ll allocate a portion of your assets to a smart beta ETF – a type of ETF that favors equities with certain characteristics which may help enhance your overall returns. Factors, or specific characteristics of stocks that have performed well historically, are utilized to select stocks. This strategy also combines elements of active and index investing.

These strategies seek to outperform a benchmark index and typically aim to enhance returns or minimize risk relative to a traditional market-capitalization-weighted benchmark. An ETF employing a smart beta strategy may have higher portfolio turnover which may indicate higher transactions costs relative to its benchmark. Utilizing smart beta strategies does not guarantee against underperformance relative to a more traditional market-capitalization-weighted benchmark.

Core Portfolios (Socially Responsible): Looking to align your investing with your personal values? We’ll adjust your portfolio to include an ETF that focuses on companies known for their environmental, social, and governance practices. Socially responsible ETFs invest to a specific mandate, including incorporating SRI criteria into investment analysis; screening for companies that adhere to environmental, social, or governance standards; or fixed income ETFs focused on community impact securities.

SRI strategies may eliminate or limit exposure to investments in certain industries or companies that do not meet certain environmental, social, or governance criteria. As a result, the ETF may underperform other funds or an appropriate benchmark that do not have an SRI focus.

Can self-directed trades be placed in a Core Portfolios account?

No, Core Portfolios is designed for investors who want ongoing help and professional guidance to manage their account. Please keep in mind, Core Portfolios is a discretionary program and only MSSB can place trades in a Core Portfolios account. Of course, if investors would like to do some investing and trading on their own, they can open a MSSB self-directed brokerage account at any time.

Does Core Portfolios offer cash management features, such as free checking?

Core Portfolios is managed with a long-term perspective in mind. Frequent cash withdrawals might make the portfolio difficult to manage and cause it to deviate from its objectives. To avoid this problem, Core Portfolios doesn’t offer features such as check writing, debit cards, and Bill Pay. However, we don’t want to stand between clients and their cash. If you need to make a withdrawal select “Withdrawal” under “Move Money” tab on your account dashboard and follow the instructions. Customer Service can be reached anytime at 866-484-3658 for any questions. You can also transfer money online to another account and withdraw it from there.

What tax-efficiency features are offered by Core Portfolios?

Tax-sensitive investment strategy is available in Core Portfolios account.

Tax-sensitive investment strategy utilizes municipal bond ETFs that may help reduce taxes incurred on interest and dividends associated with those portfolios. All brokerage accounts are automatically enrolled in a tax-sensitive portfolio. Once enrolled in Core Portfolios, you can update this feature at any time. IRAs and other tax-advantaged account types are also eligible for Core Portfolios.

What is tax-loss harvesting?

Tax-loss harvesting is a tax-efficient investing strategy that can potentially help minimize the amount of current taxes you have to pay on your investments. Under current US federal tax law, you may be eligible to offset your capital gains with capital losses incurred during that tax year or carried over from a prior tax return through tax-loss harvesting.

What accounts are eligible for tax-loss harvesting?

All active taxable Core Portfolios accounts are eligible to enroll in tax-loss harvesting. Once enrolled, Core Portfolios will monitor the enrolled account for tax-loss harvesting opportunities.

What are the benefits and considerations of tax-loss harvesting?

Tax-loss harvesting may potentially allow you to write off losses against any of your capital gains. Additionally, you may be able to write off losses up to $3,000 of ordinary income. Any losses that are not used against your capital gains and/or income in a given year may be carried over to the next year.

However, tax-loss harvesting may not always be beneficial. It may create an undesirable tax liability if your future tax bracket is expected to be higher than your current one. If you expect to be in a higher tax bracket in the future, it may not make sense to enroll in tax-loss harvesting. Additionally, tax-loss harvesting may not be appropriate for accounts with a shorter time horizon, as you may wish to avoid realizing short-term capital gains.

There is no guarantee that any harvesting request will achieve any particular tax result. MSWM does not provide you with any tax advice in connection with tax-loss harvesting. Tax-loss harvesting may adversely affect the investment performance of your account(s).

Please note that Morgan Stanley does not provide legal, tax or accounting advice. For additional information, please consult IRS guidelines and your tax advisor.

How do I enroll/unenroll my account in tax-loss harvesting?

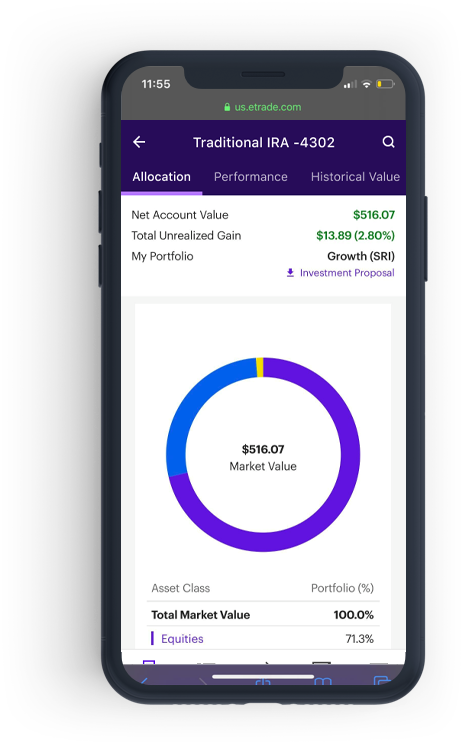

Visit the “Allocation” tab within Portfolios. Select an eligible account. Under “Tax-Loss Harvesting” near the top of the page, select “Enroll.”

To unenroll, select “Unenroll” in the same location.

What happens after I enroll my account in tax-loss harvesting?

Once you enroll in tax-loss harvesting, we will monitor your Core Portfolios account to find potential for tax-loss harvesting opportunities. When we find that you could potentially lower your tax bill by harvesting losses, we'll perform tax-loss harvesting for you automatically. There are no trading costs to harvest your losses, and we'll look to purchase a replacement security in the same investment asset class to ensure you keep your target exposure.2

How will I be notified of tax loss-harvesting transactions on my account?

We will send you an alert at enrollment, and when each tax-loss harvesting trade is executed.

Where do I see the impact of tax-loss harvesting on my account?

Visit the Allocation tab within Portfolios. Select the account enrolled in tax-loss harvesting. Your realized losses since initial enrollment will be reported under “tax-loss investing.”

Still have questions about tax-loss harvesting?

Refer to these articles to learn more about tax-loss harvesting and how to get started: