Cryptocurrency

Get up to $1,000 $1,500 for a limited time1

Open and fund a new brokerage account with a qualifying deposit by 6/30/2026. Learn how

Terms apply. Use promo code: OFFER26

Investment Choices

Investors can gain exposure to cryptocurrencies without directly owning them using securities that track or own assets tied to cryptocurrency and services in the crypto industry.

Available in brokerage accounts and IRAs

No crypto wallet and storage required

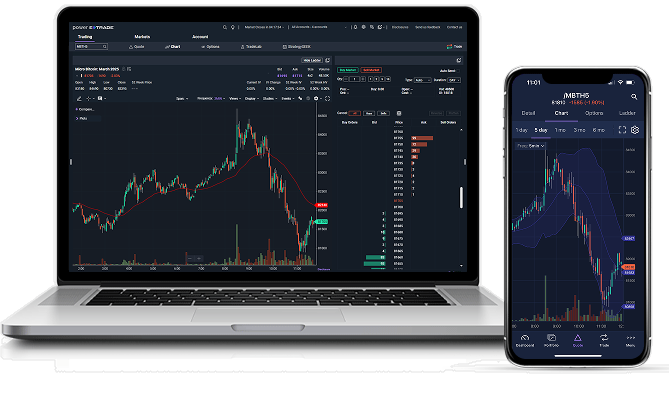

Exchange-traded products (ETPs), exchange-traded funds (ETFs), and coin trusts can be traded on all E*TRADE and Power E*TRADE platforms and mobile apps.

Futures can be traded on Power E*TRADE web and app

Cryptocurrency Spot ETPs*

Spot Bitcoin ETPs and spot Ethereum ETPs allow investors to gain direct exposure to these cryptocurrencies without holding them.

These products are listed on a traditional stock exchange but unlike other types of crypto ETFs, spot ETPs don't use derivatives, such as futures, to track the prices of Bitcoin and Ethereum—the cryptocurrencies are simply the underlying asset.

All Cryptocurrency-related ETPs and ETFs

To view all the ETPs and ETFs available to trade at E*TRADE that offer indirect exposure to cryptocurrency, visit our screener.

Cryptocurrency Coin Trusts^

Cryptocurrency coin trusts allow investors to trade shares in trusts that hold large pools of digital currency. They trade like over-the-counter stocks, but they may charge management fees and may trade at a discount or premium to the underlying cryptocurrency.

Crypto Futures

Futures provide leveraged exposure to the underlying cryptocurrency without directly owning it.

They can be used by experienced traders to speculate on the price going up or down in the short term, or to hedge long-term cryptocurrency holdings. Micro-Bitcoin contracts, at 1/10 of a Bitcoin, allow traders to fine tune exposure.

Go long or short, nearly 24/62

Trade nearly 24 hours a day, 6 days a week

CFTC regulated3

Leverage is a double-edged sword and can invoice significant risk of loss

Global liquidity

Contract are cash settled and do not provide delivery of the coins at expiration

Taxed at 60/40 capital gains

For more experienced traders and not for long-term buy and hold

Available Contracts

Futures trading is available on Power E*TRADE Web and the Power E*TRADE app with a $1.50 commission per contract, per side. See futures contract specs for full details.

/BTC

Bitcoin Futures

Tick size: 5

/MBT

Micro Bitcoin Futures

Tick size: 5

/ETH

Ether Futures

Tick size: 0.5

/MET

Micro Ether Futures

Tick size: 0.5

Note: Other risks may apply. Futures sweep functionality and global buying power applies to cryptocurrency products.

CRYPTOCURRENCY FUTURES INVOLVE A HIGH LEVEL OF RISK AND MAY NOT BE APPROPRIATE FOR ALL INVESTORS. BEFORE TRADING A CRYPTOCURRENCY FUTURES PRODUCT, YOU SHOULD CAREFULLY CONSIDER YOUR RISK TOLERANCE AND YOUR WILLINGNESS AND FINANCIAL ABILITY TO SUSTAIN LOSSES. PLEASE VISIT NFA AND CFTC FOR ADDITIONAL INFORMATION REGARDING THE RISKS RELATING TO THESE PRODUCTS.

Key takeaways

Learn more about cryptocurrency

Stay informed on the latest cryptocurrency market dynamics and innovations shaping the future of digital finance.

Get up to $1,000 $1,500 for a limited time1

Open and fund a new brokerage account with a qualifying deposit by 6/30/2026. Learn how

Terms apply. Use promo code: OFFER26