How can a robo-advisor help me invest?

E*TRADE from Morgan Stanley

09/27/24Summary: Robo-advisors leveled the playing field and made professional money management more accessible to people regardless of their income or size of their portfolio. Here’s what you need to know.

What is a robo-advisor?

The idea of letting a robot manage your money may seem futuristic, but many financial companies now offer robo-advisors to do just that. Robo-advisors are also commonly known as “robos,” “online or digital advisors,” or “automated investment management.” Here at E*TRADE from Morgan Stanley, our robo-advising platform is Core Portfolios.

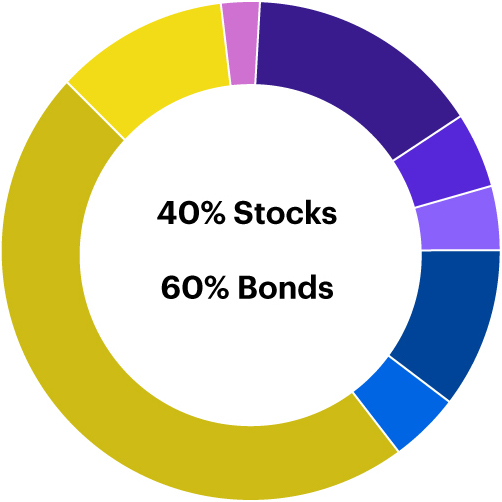

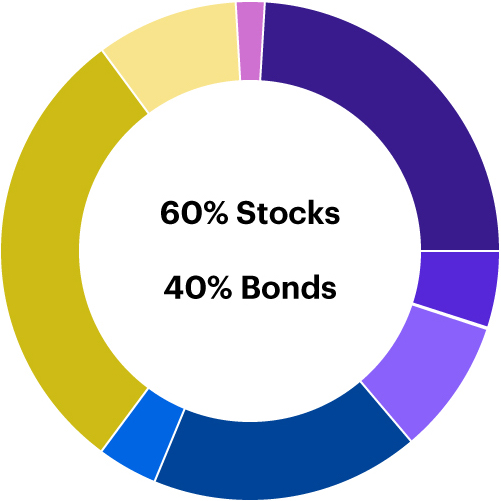

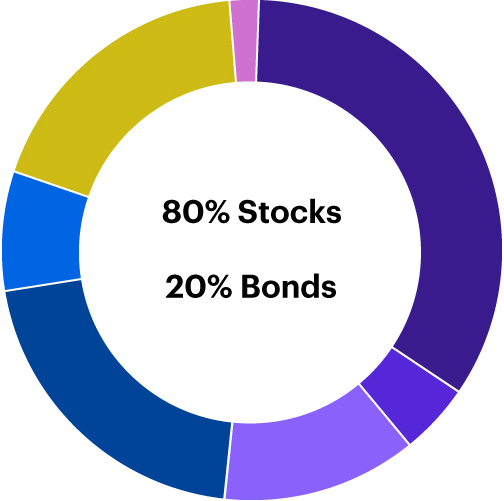

The first step in using a robo-advisor typically involves taking a short, online survey evaluating your financial goals, risk tolerance, values, and investing time horizon. This helps identify an appropriate portfolio strategy and asset allocation for you. While these portfolio strategies can vary, they generally fall into one of three general categories—conservative, moderate, or aggressive.

Conservative

Lower risk and potential return

Moderate

Medium risk and potential return

Aggressive

Higher risk and potential return

After you select the asset allocation and enroll in the portfolio, the robo uses an algorithm to automatically invest and manage your assets—a feature that may appeal to new investors without a lot of previous investing experience or who prefer to delegate their investing.

Robo-advisors typically invest in exchange-traded funds (ETFs) to give investors broad diversification with low underlying expenses. They select different types of ETFs to help manage investment returns and market risk with diversification.

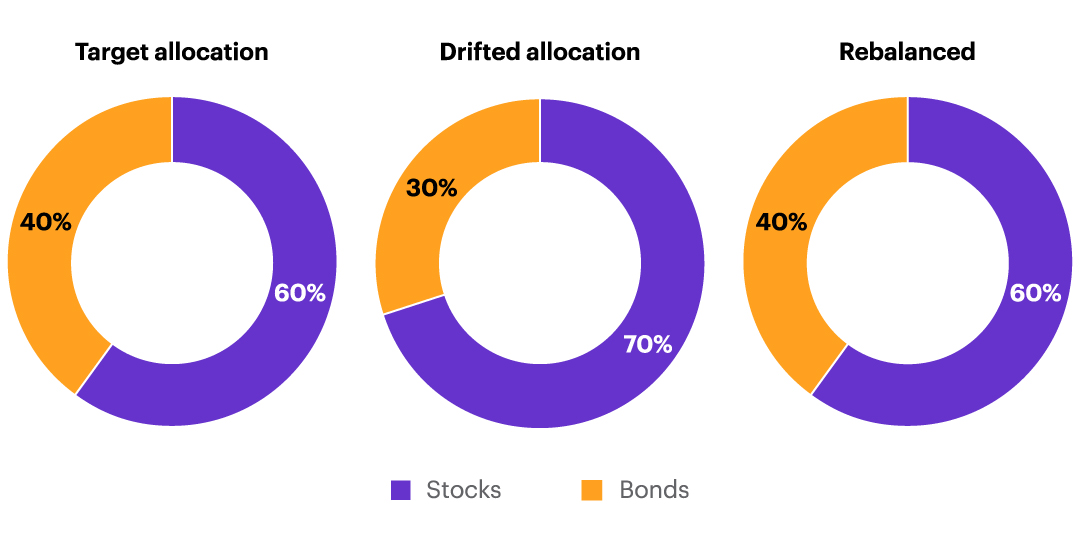

Robos also take market movement into account. So, if your portfolio’s target allocation fluctuates too far outside your desired asset allocation, the robo will automatically rebalance your portfolio to get back to its original targets.

Considering a robo?

The natural follow-up question is: Is it right for me?

Like human advisors, not all robo-advisors are the same. You can learn about a specific robo-advisor’s fundamental features in a document called a Form ADV. This document outlines the fees, asset allocations, and investment vehicles used by the robo.

Consider these five factors when deciding whether a robo makes sense for your financial situation:

- Affordability. Investors pay relatively low fees for robo-advisors. To put it in perspective: A human advisor typically charges an annual fee of 1%–2% of a client's total account balance, whereas a typical robo's advisory fee ranges from 0.30% to 0.50%. E*TRADE Core Portfolios have an annual fee of 0.30% and a minimum investment requirement of $500.

- Automation. Robo-advisors do require some initial human decision-making to construct the portfolios. After that, automated technology helps your portfolio stay on track. This helps remove the human emotion in building and managing a portfolio and may be useful for investors who aren’t comfortable making regular investing decisions.

- Customization. You can develop a portfolio based on your personal risk tolerance, the amount and frequency you want to invest, and your investing time horizon. Robo-advisors, including E*TRADE’s Core Portfolios, also can offer enhancements, such as socially responsible investments (SRI) that match your personal values or smart beta ETFs, which aim to outperform their benchmark index by favoring securities with certain features.

- Long-term focus. Many robo-advisors are designed for long-term investors because you typically see the benefits from routine automated investing over months and years, not immediately. As such, robos may be less ideal for active professional traders or day traders looking for quick gains.

- Accessibility. Robos are digital in nature, making them favorable for investors who want to manage their finances online. Robos make it seamless to open an account, select desired investments, and monitor a portfolio all with a mobile device or on your computer. Some robos—like Core Portfolios—offer “hybrid” services, providing access to human support when you need it.

Bottom Line:

The automated approach, ease of use, lower entry point, low fees, and human support inherent in E*TRADE’s robo-advisor make it a potentially attractive investing strategy for new investors.

CRC# 3777621 09/2024

How can E*TRADE from Morgan Stanley help?

Core Portfolios

Automated investment management

Get a diversified portfolio that’s monitored and managed for a low annual advisory fee of 0.30% and $500 minimum.

Automatic investing

Looking to build good financial habits? Consider setting up recurring investments in a retirement or brokerage account.

Premium Savings Account

Boost your savings with 3.75% Annual Percentage Yield for 6 months1

With rates 9X the national average2 and FDIC-insured up to $500,0003; certain conditions must be satisfied.

Morgan Stanley Private Bank, Member FDIC.

Thematic Investing

Find ETFs that align with your values or with social, economic, and technology trends.