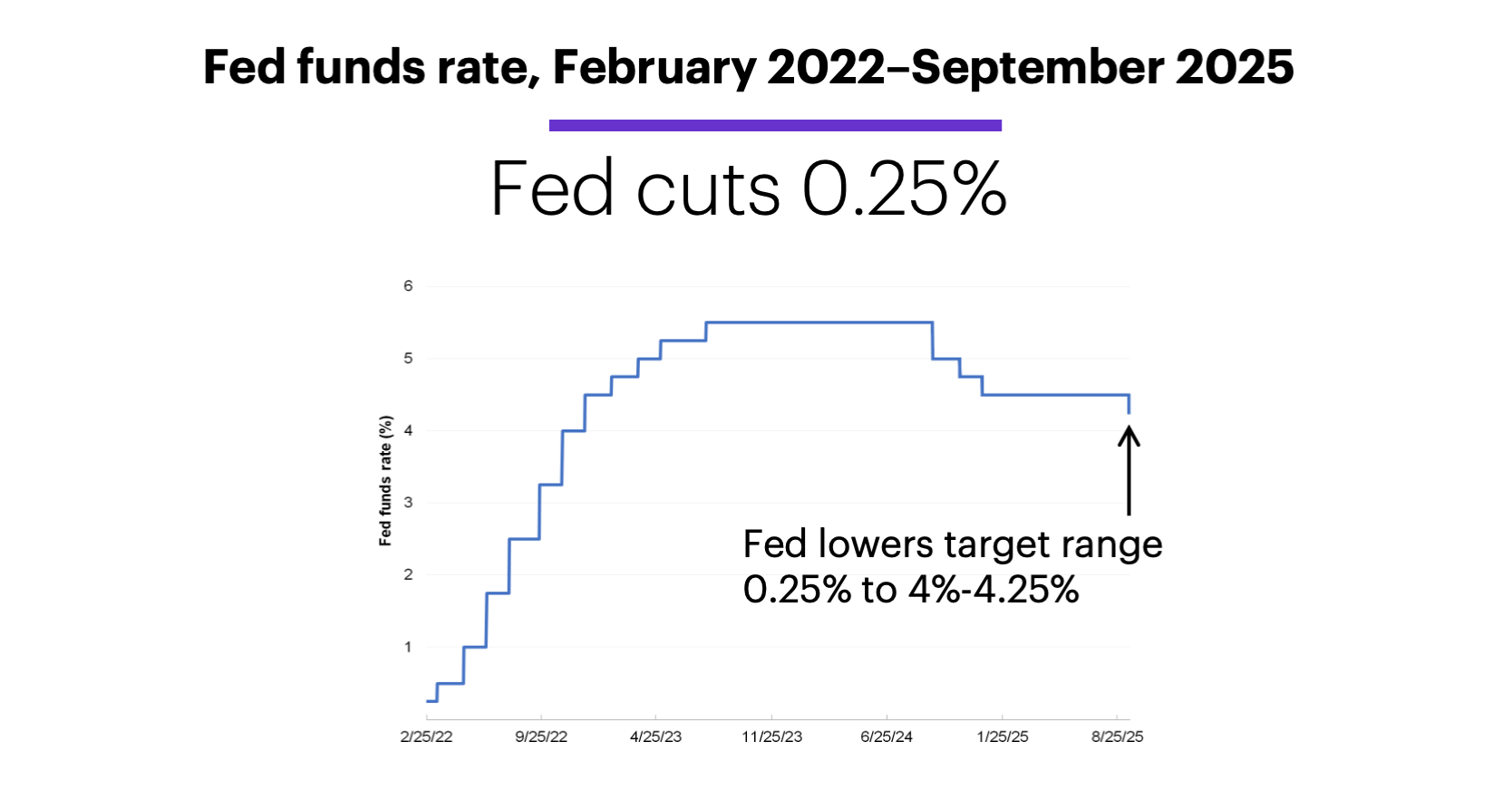

Fed makes expected cut

The Federal Reserve cut interest rates by 0.25% to a target range of 4%-4.25%, the first time it lowered its benchmark lending rate since last December:

Source (data): Federal Reserve. Values represent upper end of Fed funds target range. (For illustrative purposes. Not a recommendation.)

While inflation has remained above the Fed’s 2% target, evidence of a slowing labor market prompted the central bank to resume cutting interest rates. The Fed had been on hold for several months because of concerns that lowering rates could exacerbate the inflationary risk posed by tariffs. But a recent string of soft employment data appeared to convince the committee that the weakening labor market posed a bigger risk to the economy.

Although economic growth has slowed and inflation in some core goods has increased, tariffs have—so far—not had the impact some economists forecasted. However, there is still debate as to whether this impact has been delayed rather than avoided—an uncertainty the Fed repeatedly cited as it left interest rates unchanged despite White House pressure to do so.

Morgan Stanley & Co. currently expects the Fed to cut rates by 0.25% at its next three meetings, then pause to assess incoming economic data.

Ellen Zentner, Chief Economic Strategist for Morgan Stanley Wealth Management, recently explained that the current labor-market weakness is a function of shifting policies on trade, immigration, and government downsizing, along with the first signs of AI disruption. But while she notes that leading indicators point to further weakening, she says the jobs market isn’t falling off a cliff, either.

Zentner also believes rate cuts have the potential to directly help the jobs picture by lowering short-term borrowing costs—which, among other benefits, may make companies more confident about expanding their payrolls.

Morgan Stanley & Co.’s baseline forecast is for the Fed to cut rates by 0.25% at its next three meetings (through January 26), then pause to assess incoming economic data.1 Morgan Stanley & Co. market strategists think additional labor market weakness in the coming months could prompt the Fed to cut more aggressively than some people expect.2

Note: The Fed’s next policy meeting is scheduled for October 28-29.

1 MorganStanley.com. MorganStanley.com. Faster cuts. 9/12/25.

2 MorganStanley.com. Weekly Warm-up: Additional Weak Labor Data Suggests a "Need for Speed." 9/15/25.