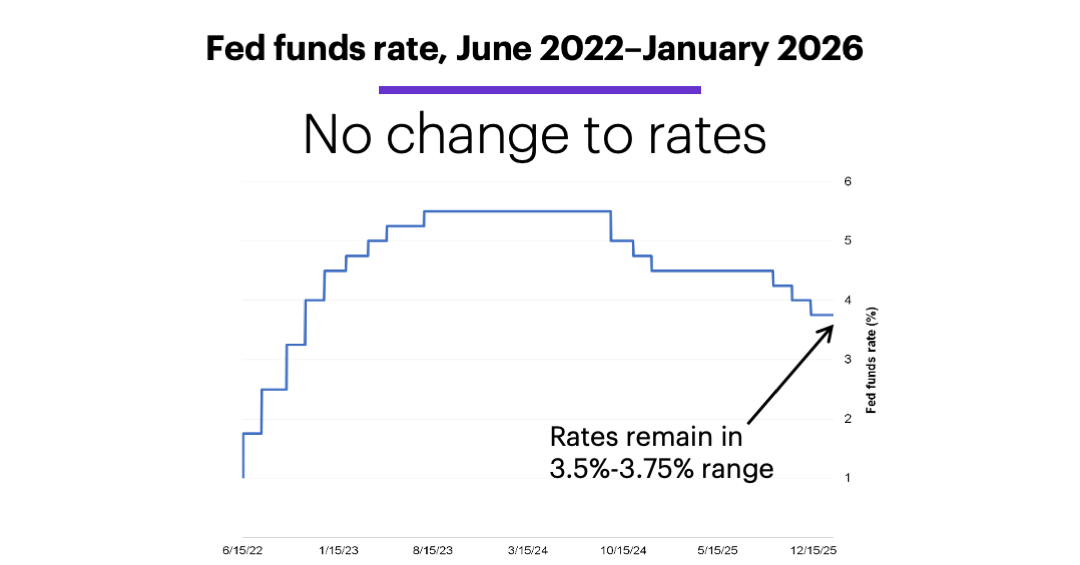

Fed pauses

The Federal Reserve kicked off 2026 by leaving its benchmark fed funds rate in a target range of 3.5%-3.75%:

Source (data): Federal Reserve. Values represent upper end of Fed funds target range. (For illustrative purposes. Not a recommendation.)

After cutting rates by 25 basis points at each of its final three meetings of 2025, the Fed was widely expected to pause to assess incoming economic data, some of which is still delayed because of last year’s government shutdown.

After trimming interest rates three times in late 2024, the Fed left them unchanged until September 2025 because of concerns about potential tariff-driven inflation. However, a string of soft employment data convinced the committee that a weakening labor market posed a bigger risk to the economy, and that lower rates were called for.

However, while data suggests the jobs market is still in a sluggish “low-hire, low-fire” mode, there’s been no indication it currently faces heightened risk. Similarly, inflation has remained above the Fed’s 2% target, but it hasn’t shown signs of turning sharply higher.

Prior to the meeting, Morgan Stanley & Co. strategists expected Chair Powell to signal a growing consensus within the Fed board for a favorable economic outlook for 2026.1 They anticipated additional rate cuts in the second half of the year.2

Note: The Fed’s next policy meeting is scheduled for March 17-18, 2026.

1 MorganStanley.com. January FOMC Preview: How Hawkish a Hold? 1/23/26.

2 MorganStanley.com. Fed Speak this Week: On hold in Jan, fewer divisions on the outlook. 1/16/26.