What factors affect Bitcoin's price?

E*TRADE from Morgan Stanley

02/28/25Summary: The price of cryptocurrencies is impacted by supply, ‘halving’ and demand. Here are several factors that may affect the price of bitcoin.

Bitcoin is one of the most volatile digital assets and cryptocurrencies. Because its extreme volatility carries the potential for high reward as well as very high risk, it's worth investigating some of the factors that may influence bitcoin's price.

Limited supply

Bitcoin's current supply and rate of growth are set by code. There are a total of 21 million coins, of which more than 94% have already been mined.1

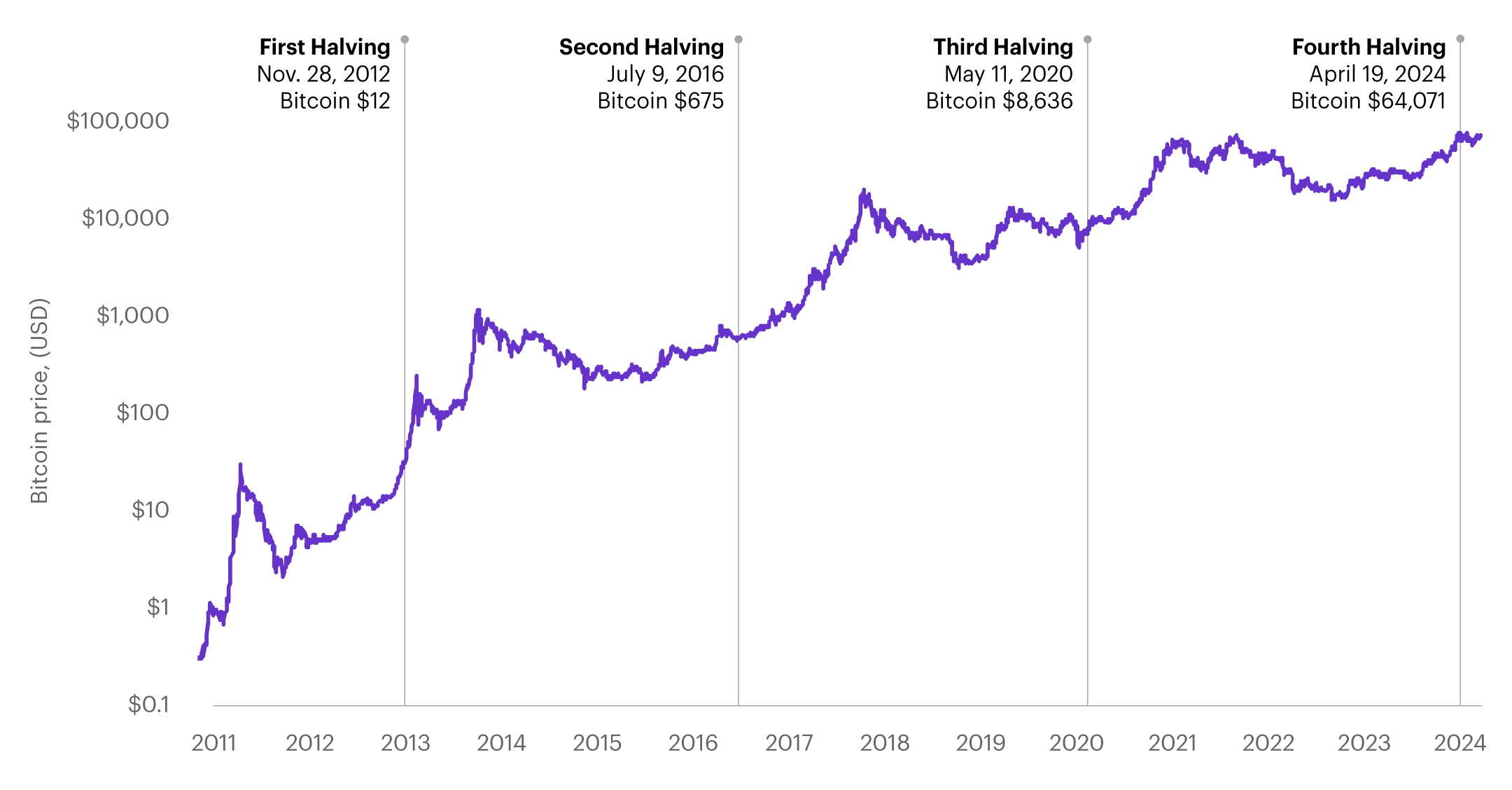

Every four years, the rate at which bitcoins are produced is cut in half (an event called the “halving”). As fewer coins are available to mine, the expense and time it takes to produce them increases. Similar to supply shocks in commodity markets such as oil or gold, a decline in annual production of bitcoin may affect its price. In its short history, there have been four bitcoin halvings. The first three have been followed by a price spike and a collapse. However, the fourth saw record breaking highs prior to its halving in April 2024.2 The next halving is expected to occur in 2028.

Price shocks following bitcoin halvings

Past performance is no guarantee of future results.

Source: Bloomberg, Blockchain.info, as of 05/31/24

Speculation

Bitcoin’s price fluctuates wildly—sometimes by several thousand dollars in a single day—which can encourage speculation and inflate demand.

Media attention can further fuel speculation and churn up volatility. Generally, negative press may lead to panic-selling by some bitcoin owners, which drives the price down. The inverse is also true, positive news tends to jolt the price.

Accessibility and liquidity

With the increased use cases for bitcoin, its price has tended to rise. And, the more people hold bitcoin, it is more likely to rise in value, as currencies with more users are typically valued higher than currencies with fewer users. Some market participants, including exchanges, have created or are in the process of creating investment products based on bitcoin, such as futures, exchange-traded products (ETPs), and mutual funds making it accessible to a broader investor base.

Despite the wide landscape of cryptocurrencies, bitcoin is considered the largest and most liquid with Ethereum coming in second.3 Typically, bitcoin can be easily bought and sold on exchanges and converted to and from cash. Liquidity is often good for price stability, however, changes in liquidity may make bitcoin prone to price swings. Since more liquidity makes it easier to buy and sell an asset, assets with higher liquidity like bitcoin may be more valuable to investors and traders.

As a decentralized digital currency, bitcoin is not pegged to the US dollar or any other fiat currency (physical money). Its price may vary from exchange to exchange.

Risks and investing considerations

In the US, bitcoin is legal, but not considered or recognized as legal tender. The IRS treats income generated from cryptocurrencies and digital assets as taxable.5 The U.S. Securities and Exchange Commission (SEC) doesn’t directly regulate bitcoin unless it’s in the form of a cryptocurrency-related ETP.

Some countries have banned the buying, owning, or trading of cryptocurrency, others are threatening to enact prohibitive regulation, and still others are cautiously accepting it. Laws may be passed, nationally and internationally, that could affect taxes, ownership, and liquidity.

Other risks may affect supply and demand and ultimately influence bitcoin’s price. Most cryptocurrencies, given their digital nature, are particularly prone to cyberattacks with an estimated $2.2 Billion stolen in 2024.4 While the encryption behind Bitcoin’s blockchain has never been known to be broken, individual holders, as well as entire exchanges, have been compromised, which can create instability in bitcoin’s price.

Navigating bitcoin

As a decentralized digital currency, bitcoin is not pegged to the US dollar or any other fiat currency (physical money). Its price may vary from exchange to exchange.

Investors in this space should proceed with caution, understanding that the price of bitcoin is exceptionally volatile, and its future value may hinge heavily on broader public adoption.

Investors should educate themselves and consider how and if exposure to cryptocurrency aligns with individual goals, timelines, and risk tolerance.

Article Footnotes

1 Bitcoin price today, BTC to USD live price, marketcap and chart, Accessed on Feb 11, 2025, https://coinmarketcap.com/currencies/bitcoin/

2 Bitbo, "Bitcoin halving progress," https://charts.bitbo.io/halving-progress/

3 Cryptocurrency Prices, Charts And Market Capitalizations, Accessed on February 11, 2025, https://coinmarketcap.com/

4 $2.2 Billion Stolen from Crypto Platforms in 2024, but Hacked Volumes Stagnate Toward Year-End as DPRK Slows Activity Post-July, December 19, 2024, https://www.chainalysis.com/blog/crypto-hacking-stolen-funds-2025/#:~:text=In%202024%2C%20funds%20stolen%20increased,about%20halfway%20through%20the%20year

5 Digital assets, Accessed on: January 16, 2025, https://www.irs.gov/filing/digital-assets

CRC# 4281935 02/2025

Bitcoin Exchange-Traded Products (ETPs)

Spot bitcoin ETPs and futures-based bitcoin exchange-traded funds (ETFs) make it simple to invest in bitcoin without the trouble of owning the cryptocurrency itself.

Cryptocurrency

Cryptocurrencies are not offered directly via E*TRADE, but it is possible to gain indirect exposure to popular cryptocurrencies via securities and futures.