Undervalued large firms

ETFs

Rating

Change

Ratio

Data quoted represents past performance. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Your investment may be worth more or less than your original cost when you redeem your shares. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance and current performance metrics, please click on the fund name.

Check out other thematic investing topics

Small companies

Find ways to invest in smaller companies that offer opportunities for long-term growth potential.

Health care innovators

Discover how to put your money behind health care and biotechnology companies that are pursuing medical breakthroughs.

Emerging economies

Explore ways to diversify your portfolio by considering investing in countries with developing economies that may be growing rapidly.

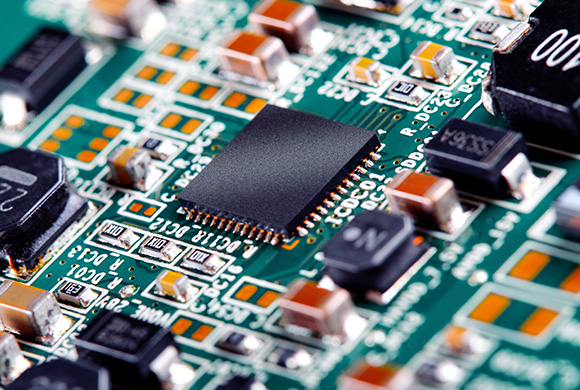

Technology pacesetters

Learn how to invest in leading technology innovators that are looking to change the way the world works.

Get up to $1,000 $1,500 for a limited time1

Open and fund a new brokerage account with a qualifying deposit by 6/30/2026. Learn how

Terms apply. Use promo code: OFFER26