The 7 political trends investors should watch to stay ahead

Morgan Stanley Wealth Management

04/17/24Summary: Here’s how the top policy changes coming out of Washington in 2024 may impact your investments.

The U.S. election, fast-changing world events, and government policy may impact your investment performance in the year ahead. Here are the top policy actions to watch, along with what it may mean for your portfolio.

1. The market impact of the election

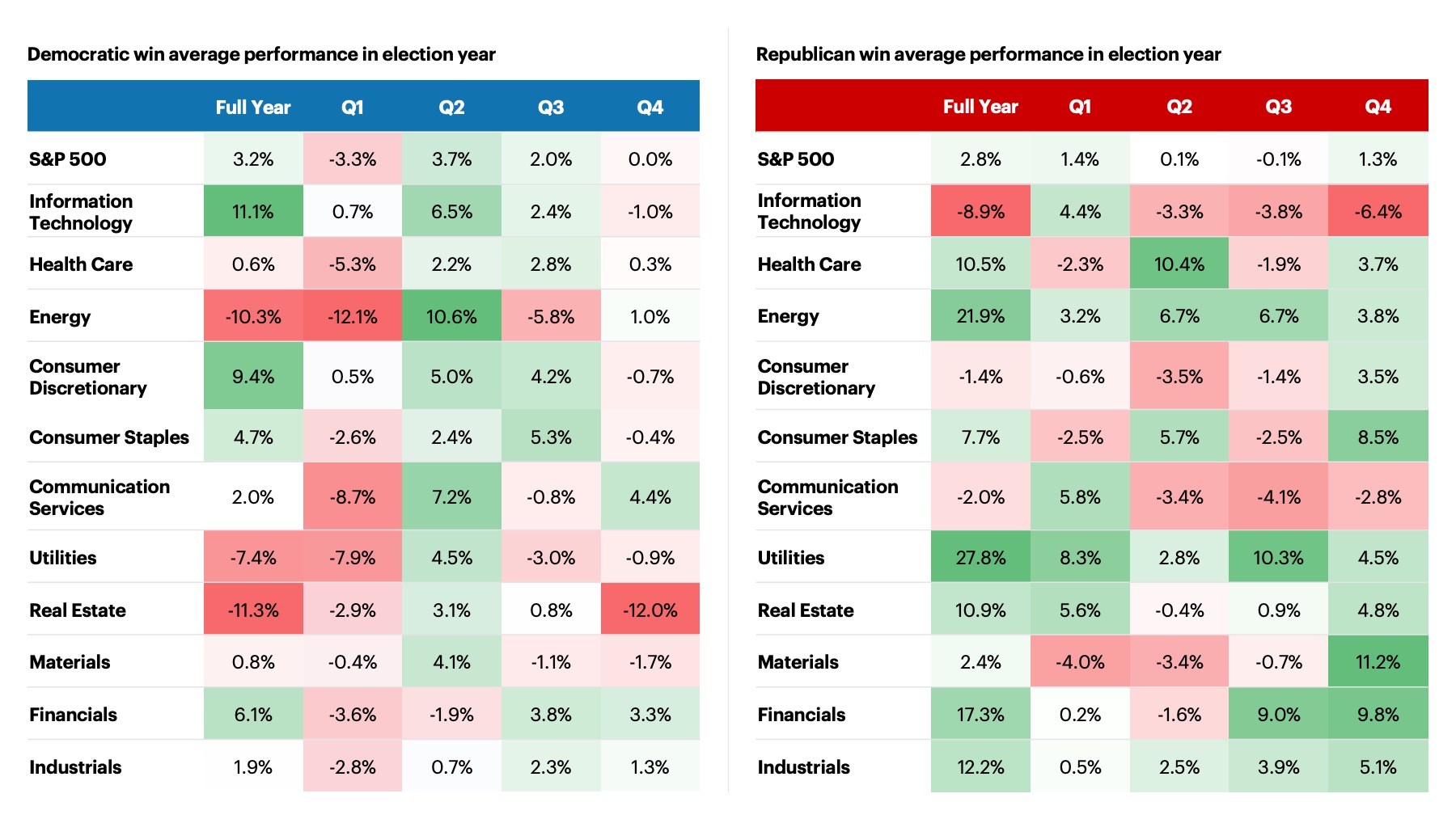

While it is still unclear who will win the Presidential election this November, investors may benefit regardless. On average, the S&P 500 generates a positive return of about 3% in an election year, regardless of which party is the victor. However, specific sectors may outperform, driven by the party of the winner.

Investor implication: The winner can potentially impact specific sector performance (see the chart below). For example:

- Utilities, Energy and financials tend to perform better when a Republican wins, while Information Technology underperforms.

- IT and consumer discretionary tend to outperform when a Democrat wins, while real estate and energy underperform.

With some sectors potentially experiencing a double-digit swing based on the winner, now is the time to review your portfolio.

Sector Returns by Winning Party

Note: Indicates sector performance for each election year quarter, ending on Dec. 31 of that election year. Source: Bloomberg, Morgan Stanley Wealth Management Global Investment Office as of Jan. 9, 2023

2. Finding safety amid global conflict with defense stocks

Just as war in Ukraine and the Middle East continues to dominate the headlines, defense stocks continue to outpace the market. While both U.S. and European defense contractors have beaten the S&P 500 since Russia’s invasion of Ukraine, European defense stocks have significantly outperformed their U.S. counterparts as well as broad-based US and European indexes by more than 40% due to higher NATO defense spending and the immediacy of war on their doorstep1.

Investor implication: U.S. defense stocks may catch up in the coming year thanks to a renewed focus on military competitiveness, signified by the recent 3.2% defense budget increase passed by Congress, and a possible defense supplemental currently being negotiated. In addition to traditional defense manufacturers of missiles, munitions, ships, and the like, other industries may be positioned to benefit from defense spending tailwinds, such as:

- Cybersecurity solutions developers

- Semiconductor manufacturers

- Satellite providers

3. The winner of U.S. versus China: Mexico?

While the U.S. and China relationship has been relatively calm in recent months, the US election and the election outcome in Taiwan could increase strain in 2024.

In addition, the U.S. has continued to restrict exports of advanced AI chips and manufacturing equipment while retaining and possibly increasing tariffs. As a result, U.S. direct investment in China has dropped by 38% from $13 billion in 2019 to $8 billion in 20222.

Investor implication: All that trade has to go somewhere. Recent deglobalization, derisking, and trade policy trends point to U.S. firms “reshoring” their key supply chains to bring them back to North America, which could potentially lead to Mexico overtaking China as the largest source of U.S. imports.

4. Changes may be coming to retirement plans

Investors saving for retirement should get more clarity in 2024 for what to expect from their investing options and strategies moving forward. Specifically, we’re expecting clarification about:

- Increased catch-up contributions to retirement accounts

- Rules for leveraging non-security investment products like fixed-income annuities in retirement accounts.

Investor implication: Policy changes and new legislation can have a major impact on the way you save for retirement. Changes could help people:

- Further solidify their financial future by allowing more catch-contributions for those aged 50 or older and

- Provide more options for diversifying their income streams in retirement.

5. Keep an eye on energy

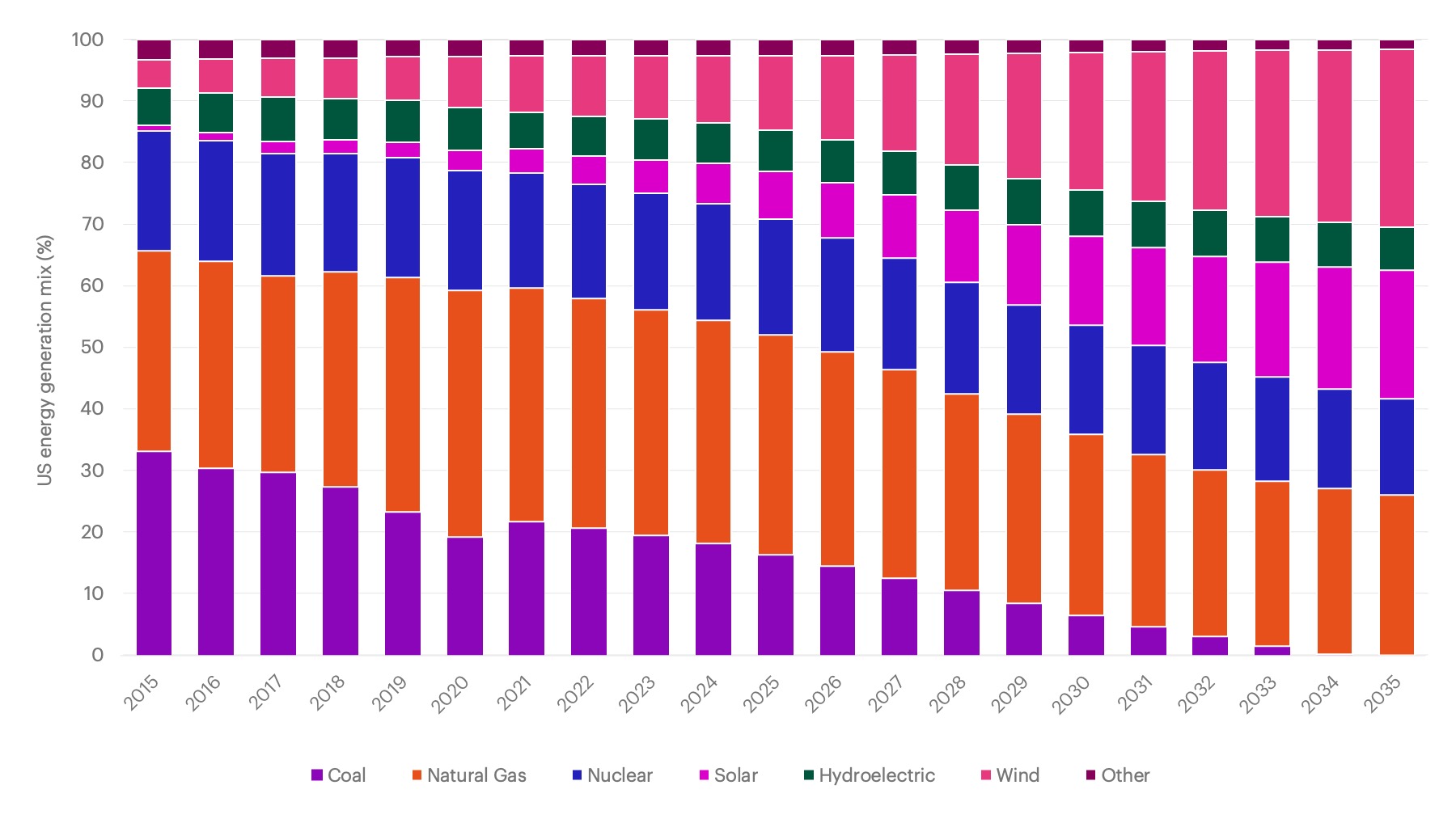

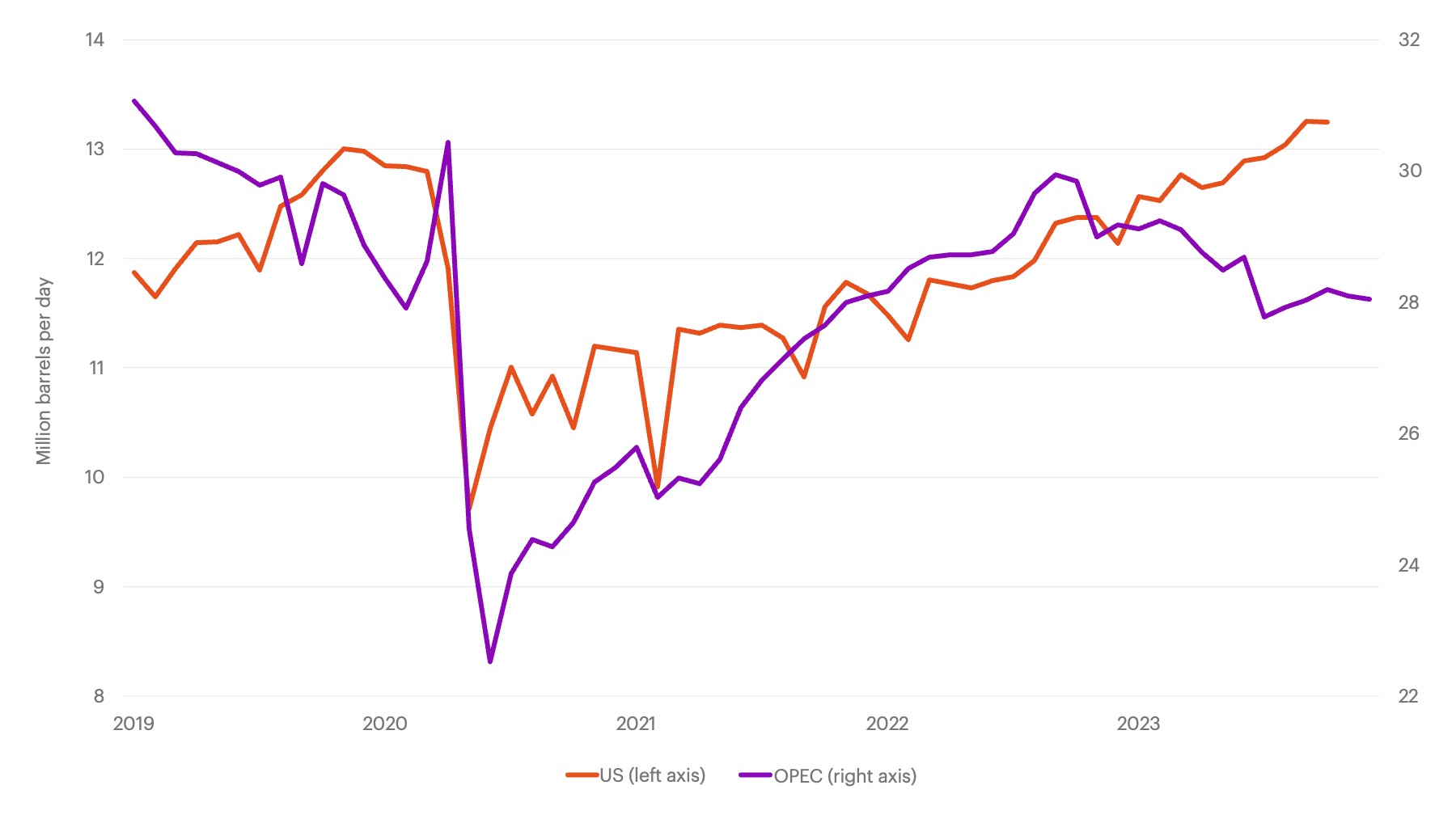

The Inflation Reduction Act allocated $369 billion for clean energy in 2023, boosting capital spending for solar and wind energy. While a GOP win in 2024 could reduce this spending, barring any policy setbacks we expect clean energy to make up half of U.S. energy generation by 2035. But don’t write off oil yet; U.S. crude production remains at an all-time high thanks to the Biden administration's support for pro-fossil fuel policies.

Solar and Wind Are Projected to Comprise 50% of US Energy Mix by 2035

Source: Morgan Stanley & Co. Research, S&P Capital IQ, Morgan Stanley Wealth Management Global Investment Office as of Dec. 8, 2023.

The US Has Produced More Oil Than Ever in the Wake of OPEC Cuts

Source: Bloomberg, Morgan Stanley Wealth management Global Investment Office as of Dec. 31, 2023

Investor implication: While the Biden administration will likely continue to promote traditional energy in order to keep gas prices low, clean energy tax credits may create a long-term tailwind for clean energy stocks.

6. Artificial Intelligence may face regulation

2023 was all about tech companies leveraging artificial intelligence (AI), but 2024 may be the year where regulators play catch up. While the White House has already issued its first AI-related executive order and Congress is working to create a legislative framework for future regulation, we believe most of the AI regulation this year is likely to come from the states.

Investor implication: 12 states are already enacting various AI reform and monitoring policies. While AI adoption may provide new investment opportunities, investors should also consider the potential of increased regulation at all levels.

12 states are already enacting various AI reform and monitoring policies. While AI adoption may provide new investment opportunities, investors should also consider the potential of increased regulation at all levels.

7. Financial services and healthcare may have surprise upside

This year, the financial industry sector should get more clarity about the Basel III Endgame proposal for increasing capital requirements for banks with at least $100 billion in assets.

In health care, investors are watching to see if the sector can overcome its recent broad weakness due to the expiration of COVID-era Medicaid expansion, the introduction of pharmaceutical price restrictions, and macro trends favoring cyclical sectors.

Investor implication:

- Thanks to robust industry backlash, the final Basel rule may be less onerous than originally anticipated, potentially providing the financial sector with an opportunity for upside surprise.

- Similarly, the health care sector’s woes are largely priced in, possibly providing the opportunity for growth in sub-sectors such as managed care, due to robust Affordable Care Act (ACA) program enrollment.

- To investigate potential investment opportunities, explore ETFs in large banks, digital banking, the broader financial sector, and healthcare innovators.

The bottom line

Stay tuned to US government policy and regulatory moves coming out of Washington D.C. this year to see how they may impact your investments. When making any investment decision, keep in mind your risk tolerance and investment goals. A Financial Advisor can help you stay ahead of these changes.

1 US Policy Pulse: 10 Policy Actions to Watch in 2024 by Monica Guerra, Morgan Stanley Wealth Management, 2024, page 3

2 US Policy Pulse: 10 Policy Actions to Watch in 2024 by Monica Guerra, Morgan Stanley Wealth Management, 2024, page 4

How can E*TRADE from Morgan Stanley help?

Shoring up supply chains

Discover ways to invest in regions that may benefit from shifting international trading and manufacturing patterns, as companies and nations look to create more secure, diversified supply chains.

Artificial intelligence

Find investing opportunities in this growing field of technology.

Premium Savings Account

NEW: Boost your savings with Annual Percentage Yield1

With rates 9X the national average2 and, FDIC-insured up to $500,0003; certain conditions must be satisfied.

Morgan Stanley Private Bank, Member FDIC.

Retirement Accounts

Whether you are exploring a Roth or Traditional IRA, or considering a rollover IRA, you’ve got choices.