How to navigate inflation

Morgan Stanley Wealth Management

03/14/25Summary: Inflation is a term that often appears in financial news, affecting everything from the economy to personal finances. But what exactly is it—and how does it impact your investments?

Persistently higher prices can put a dent in consumers’ wallets and business’ profit margins. For investors, inflation erodes the real value of returns, deflating purchasing power over time.

Inflation may cause you to reevaluate your budget to see where you can trim costs, rebalance spending, or diversify your portfolio to help hedge risks.

Here, we demystify inflation, highlighting its causes, measurements, and strategies to potentially safeguard your portfolio.

What causes inflation?

Inflation measures the increase in the cost of goods and services over a period of time, usually a year. Inflation can happen due to various reasons.

Demand-pull occurs when the demand for goods or services surpasses supply.

Potential cause:

- Increased consumer spending

- Lower interest and tax rates (expansionary fiscal and monetary policy)

- Economic expansion

Cost-push happens when rising production costs lead to consumer price increases.

Potential cause:

- Disruptions in supply chains

- Costly raw materials

- Increases in company expenses

Built-in inflation is a cycle where the population expects inflation to rise, leading to a demand in higher salaries, prompting businesses to raise wages, subsequently driving inflation higher.

Potential cause:

- Wage price spiral

- Anticipation of long-term inflation

- Increase in demand and production costs

International events like wars, pandemics, and supply chain disruptions, as well as stringent fiscal policies and lenient monetary policies, can also cause inflation.

How is inflation measured?

CPI and PCE measure different things

Source: Bureau of Economic Analysis, US Bureau of Labor Statistics, Morgan Stanley Wealth Management.

Past peformance is no guarantee of future results.

Inflation is typically measured through two indices:

- The Consumer Price Index (CPI) measures how much prices for everyday consumer goods and services—like food, rent, and transportation—increase or decrease over time. It reflects changes in the cost of living, and how it impacts consumers.

- The Personal Consumption Expenditures Price Index (PCE) is the Federal Reserve’s preferred gauge. It measures a broader range of consumer spending and indicates how consumers modify their spending habits in response to price changes.

While CPI focuses on what consumers buy per household, PCE takes into account the total value of the products and services sold, including purchases made by employers or government entities, such as medical insurance.

Economists often look at “core” measures of each index, which exclude food and energy—commodities that tend to show high volatility in their prices.

Inflation and the Fed

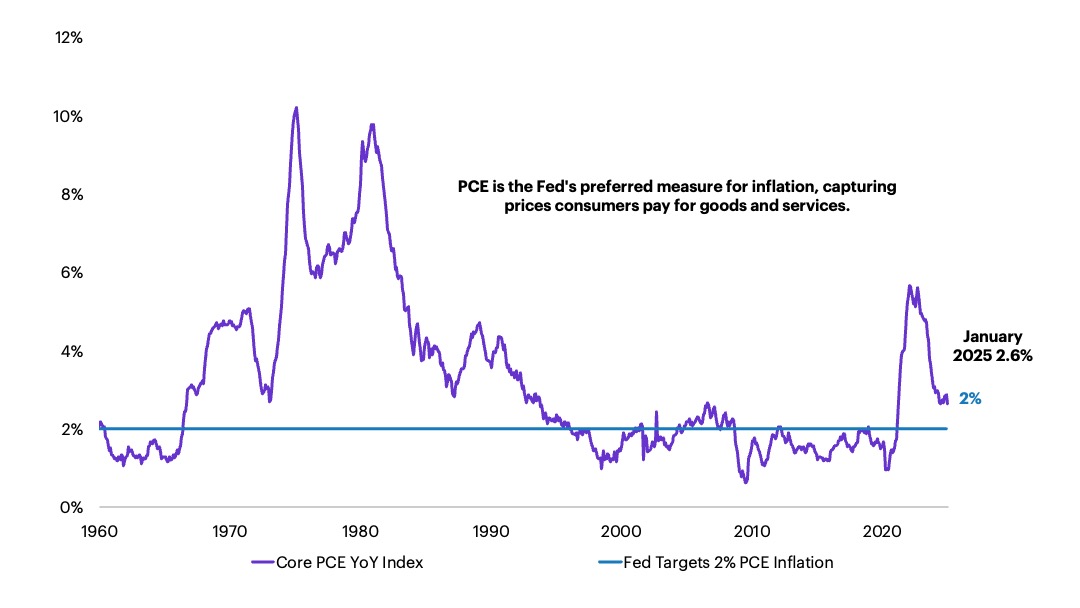

Inflation is back to levels last seen several decades ago

Source: Bloomberg, Morgan Stanley Wealth Management GIO, data through January 31, 2025.

Past performance is no guarantee of future results

The Federal Reserve plays a crucial role in managing inflation. Part of its mandate is to promote price stability, targeting a long-term inflation rate of around 2%. To control inflation, the Fed may adjust interest rates. For example, raising interest rates generally reduces consumer demand and business investment, helping cool down an overheated economy. However, it can take time for rate hikes to trickle through and ultimately cool inflation.

Stocks that can pass increased costs to consumers without losing business may help preserve (or even potentially improve) margins and profits and protect your investment from inflation.

Investment strategies to combat inflation

While no investment is entirely immune to inflation, diversifying your portfolio can help mitigate its effects. You may want to consider:

- Stocks of companies that can pass increased costs to consumers without losing business. This may help preserve (or even potentially improve) margins and profits and protect your investment from inflation.

- Exposure to real assets, including commodities such as agriculture, energy, and precious metals, real estate, and infrastructure. Historically, commodities have performed well during high inflation periods. One way to gain broad exposure to real assets is through commodity-focused funds or real estate investment trusts (REITs).

- Treasury Inflation-Protected Securities (TIPS), which offers coupon payments (returns) that adjust with inflation, helping to protect the purchasing power of your investment. For example, when the CPI rises, so does the bond’s principal value and, thus, its coupon payment. However, if the CPI falls, so does the value of the TIPS principal and its coupon payment. TIPS tend to outperform other Treasuries in periods when inflation expectations are rising.

- ETFs of securities whose values track the Consumer Price Index (CPI) or commodity prices, and typically invest in the securities mentioned above that hedge against inflation, including TIPS bonds and commodities.

Inflation is an integral part of the economic landscape that directly impacts your investment returns. By understanding it, you can better prepare and protect your portfolio. Always align your investment decisions with your individual goals, timeline, and risk tolerance.

Article Footnotes

1 Morgan Stanley Research, US Economics, “A Sharper Rise, a Steeper Fall for Inflation,” 10/14/22.

2 Economy at a Glance - Inflation (PCE), Based on Update: August 02, 2024, https://www.federalreserve.gov/economy-at-a-glance-inflation-pce.htm.

CRC# 4091981 03/2025

How can E*TRADE from Morgan Stanley help?

Bonds and CDs

These investments pay regular interest and typically aim to return 100% of their face value at maturity. Choices include everything from U.S. Treasury, corporate, and municipal bonds to FDIC-insured certificates of deposit (CDs).

Hedging Inflation

Discover ways to invest in securities that may help your portfolio resist the effects of inflation while also keeping risk and volatility in check.

Premium Savings Account

Boost your savings with 3.75% Annual Percentage Yield for 6 months1

With rates 9X the national average2 and FDIC-insured up to $500,0003; certain conditions must be satisfied.

Morgan Stanley Private Bank, Member FDIC.

Risk Assessment Tool

How risky is your portfolio?

Understanding risk is key to managing your investment performance. See your portfolio’s volatility, asset allocation and how you might fare in different hypothetical market scenarios.