The ins and outs of bond swapping

E*TRADE from Morgan Stanley

11/25/25Summary: Learn some of the main reasons why investors may engage in bond swapping.

Bond swapping is the process of selling a bond to buy another one. Why would an investor do that? Well, there are certain situations when swapping one bond for another may help meet financial goals or align with longer-term investing objectives. Let’s break down some common reasons for bond swapping.

Lower taxes

Investors often consider bond swapping to lower capital gains or ordinary income tax obligations. By selling a bond that’s trading below the price it was purchased, investors can write off the loss. The next step would be to buy a different bond with a similar yield, maturity, and credit rating. In this scenario, investors can reduce their tax obligation and stay invested.

There are two important details here. First, investors should know whether their loss would be considered short term (on a bond held less than 12 months) or long term (on a bond held longer than 12 months). When it comes to taxes, short-term losses can only offset short-term gains, while long-term losses can only offset long-term gains—and the rates at which they’re taxed are different.

Secondly, investors should make sure that the new bond purchased is substantially different from the bond sold, to avoid a wash sale. A wash sale voids any loss claimed to reduce taxes, so investors would need to swap bonds with different issuers or with differences in maturity and interest rates/coupons.

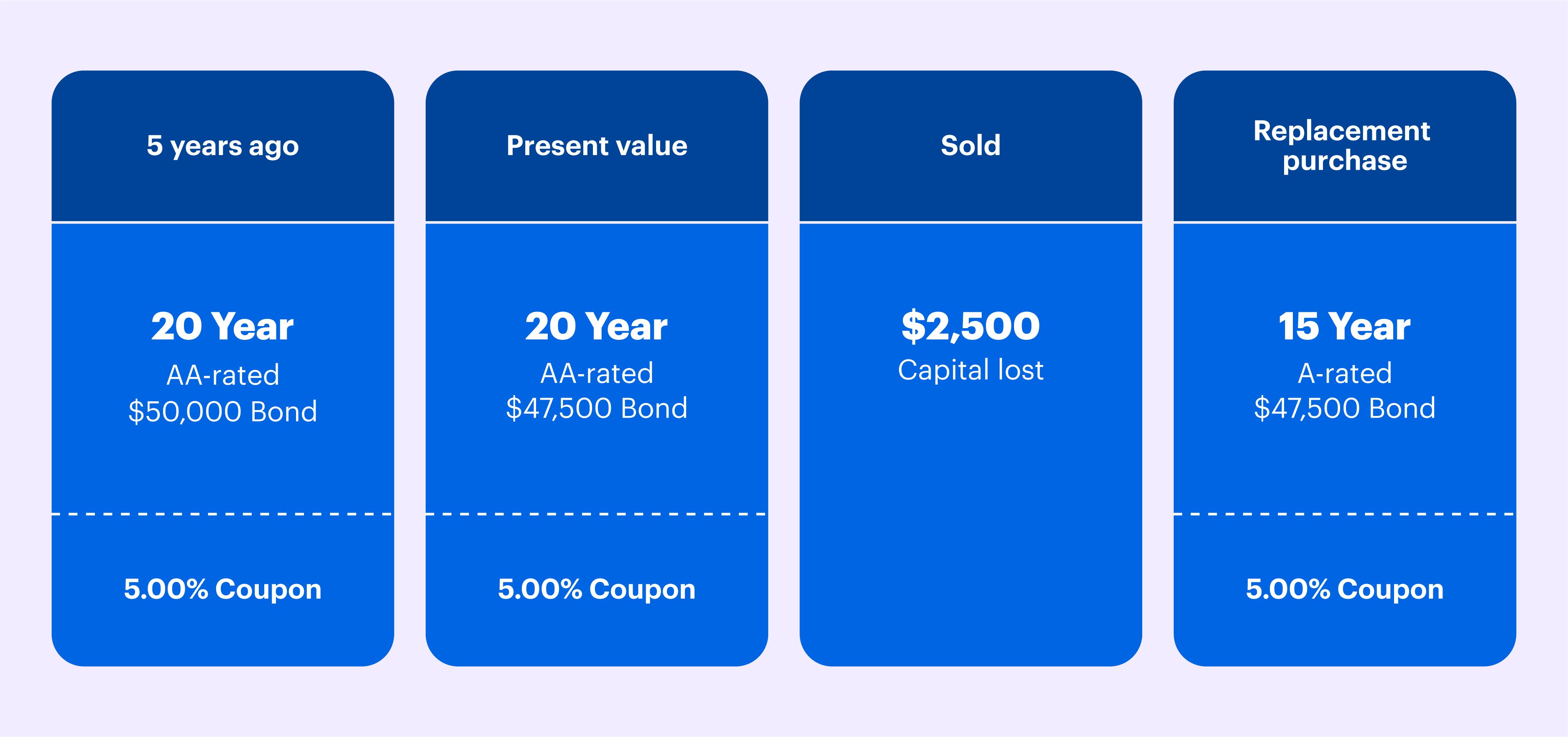

Here’s an example. Let’s say Jane bought a $50,000, 20-year, AA-rated corporate bond with a 5% coupon five years ago. It’s now worth $47,500. If Jane were to sell the bond, that would be a $2,500 loss—which she could use to offset long-term capital gains from other investments.

After selling that bond, Jane could purchase a replacement like an A-rated, 5% corporate bond with a 15-year maturity date for the same price ($47,500). In this scenario, she’d keep a bond holding with a similar yield and maturity, but a lesser credit quality while reducing her capital gains by $2,500.

Increase yield

Bond swapping could also be used to increase potential returns. One way to do this is through adjusting the duration or maturity of a portfolio. Since longer-term bonds generally come with higher yields, investors may look to swap out a shorter-term bond for a longer-term one. One risk to watch for: Bonds with longer maturities are more vulnerable to changes in price when interest rates change.

Lock in gains

In periods of persistently low interest rates, investors may find a bond holding has appreciated and is trading at a premium. Eventually, as the bond nears maturity, that premium will dissipate, and the bond will be priced at its face value, or par, even if interest rates don’t change. Investors who want to lock in gains while staying invested can sell and then use those proceeds to buy a similar bond with a yield that’s priced closer to par.

Improve quality

A bond’s credit rating is a crucial factor for evaluating the creditworthiness of an issuer. Bonds with lower credit ratings are at a higher risk of default during an economic or market downturn. Investors who are concerned about the quality of an issuer may want to swap out a lower-rated bond, say BB, for a higher rating like AA or AAA.

Take advantage of interest rate changes

Investors anticipating an increase or decrease in interest rates may want to swap bonds to hedge against potential changes in prices (remember, bond prices and interest rates move in opposite directions). Longer-dated bond prices are typically expected to rise when interest rates decline, so investors may look to extend the duration or maturity of their bond holdings when anticipating a decline in interest rates. On the other hand, if interest rates are expected to rise, investors may want to reduce the duration and maturity of their bond holdings. Shorter-term bonds are less sensitive to changes in interest rates.

Bond swapping in anticipation of interest rate changes can be risky since investors are speculating on a future outcome.

Before engaging in bond swapping, investors should work with a tax professional to understand if it fits their financial situation. E*TRADE does not provide tax advice, and you always should consult your own tax advisor regarding your personal circumstances before taking any action that may have tax consequences.

CRC# 4979508 11/2025

How can E*TRADE from Morgan Stanley help?

Need help getting started with bonds?

To get started with bonds, visit our comprehensive Bond Resource Center. Use our Advanced Screener to quickly find the right bonds for you. Or call our Fixed Income Specialists at (877-355-3237) if you need additional help.