The relationship between bonds, interest rates and inflation

Morgan Stanley Wealth Management

11/13/25Summary: Discover how changing interest rates and inflation create challenges for bond investors, and explore two potential investing strategies that may help mitigate these risks.

Bonds, also known as fixed-income securities, play an important part in investment portfolios. They can help investors:

- mitigate risk,

- reduce portfolio volatility and provide diversification,

- preserve your principal investment,

- generate a predicable income stream, and

- provide tax advantages, particularly through municipal and other tax-exempt bonds, which can offer exemptions from certain taxes.

Historically, bonds have been more predictable and less volatile than stocks over the long-term, offering investors stability and steady income. However, they are not without risk. Bond prices can fluctuate, particularly during periods of rising or falling interest rates. Additionally, issuer quality can affect their value and inflation can erode the purchasing power of their interest payments.

Let’s look at why interest rates and inflation can affect the value of bonds, and review some investing strategies that can help manage risk.

Credit risk vs. interest rate risk

Bonds carry two main risks: credit risk and interest rate risk.

- Credit risk refers to the possibility that the bond issuer may default on its debt or miss scheduled interest payments. When a company or government has a higher credit risk, they will typically have to pay higher interest rates to attract buyers.

- Interest rate risk is the potential of rising interest rates, often driven by inflation to negatively affect bond investments. This risk can manifest in various ways, such as decreasing the market value of existing bonds and ultimately diminishing overall returns.

While many investors elect to hold their bonds until maturity, they can also be bought and sold on the secondary market. Interest rate risk is often of greater focus to investors seeking to liquidate a position prior to maturity—and potentially sell at a discount to their original purchase price, locking in a loss. This risk is less of a concern for those who intend to keep their bonds until they reach maturity, since interim price swings have limited impact on the bond’s total return at maturity.

How interest rates affect bonds

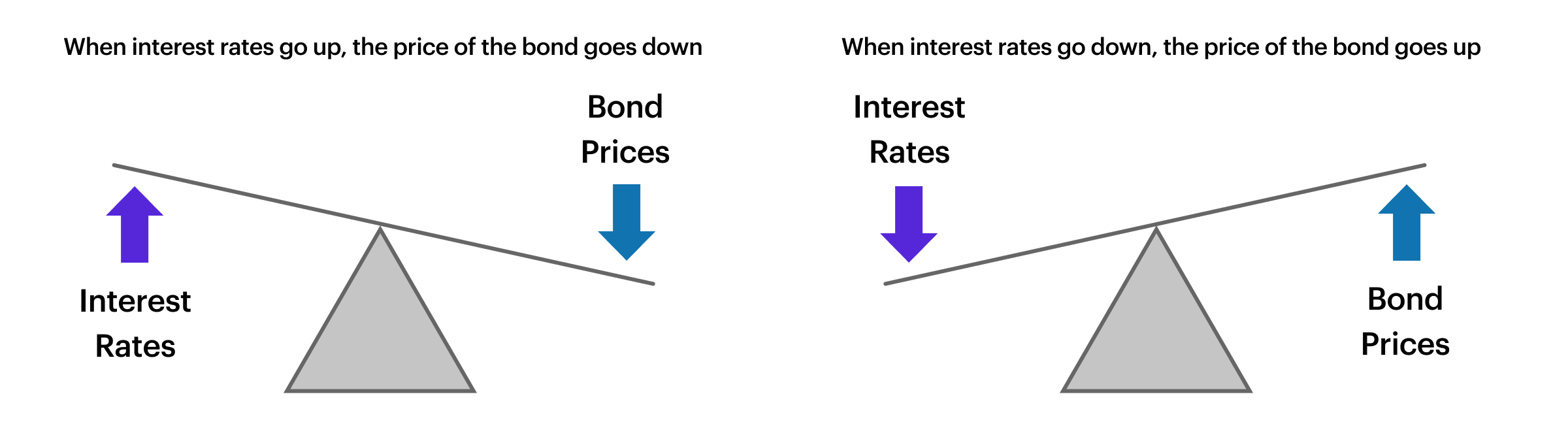

Interest rates and bond prices have an inverse relationship, similar to the opposing ends of a seesaw. When interest rates rise, a bond’s face value declines because investors can find higher yields with newly issued bonds, decreasing demand for older bonds. Conversely, when interest rates decline, older bonds with their higher rates become more valuable.

As the price of a bond fluctuates, so does its investment return known as the “yield.” While a bond's coupon is a fixed payment, its yield increases when the bond price decreases, and vice versa. This creates an inverse relationship between bond yields and bond prices, resembling a seesaw effect.

To gauge the interest rate risk of a particular bond, it’s essential to understand its duration. A bond's duration is measured in years, but it is not the same as a bond's maturity date. Duration factors in both a maturity date and the bond's coupon. Bonds with longer durations are more sensitive to interest rate fluctuations, making them riskier in terms of long-term interest rate exposure compared to bonds with shorter durations.

Inflation and interest rates: the correlation

Inflation is the rate at which the cost of goods and services increases in an economy over time. Several factors may lead to inflation, including higher production costs or greater demand for goods. As inflation escalates, the purchasing power of money diminishes, meaning that each unit of currency buys fewer goods and services than before.

In the US, the Federal Reserve (the Fed) can adjust its benchmark interest rate, called the federal funds rate, to try to either stimulate or slow inflation. The movement in the federal funds rate also affects bond rates. The Fed aims for a 2% inflation rate as it sets its policies.

The impact of inflation on bonds

As inflation and interest rate trends are related, they are important to consider when investing in bonds.

Inflation can affect fixed-income investments more than other asset classes because, with higher prices for the consumer, fixed payments have less purchasing power. So, if a bond yields 2%, but inflation is 3%, the bond’s total return decreases.

If inflation starts rising faster than expected, the Fed could raise interest rates by a greater amount and at a quicker pace, which will cause the price of fixed-income investments, like bonds and brokered CDs, to decline. Similarly, the Fed may lower interest rates if inflation is running lower than its 2% goal.

Two potential investing strategies

One way to help manage risks associated with interest rate changes is to establish a bond ladder. With this strategy, you purchase bonds with different maturity dates to create a predictable income stream that is prepared for rates to either rise or fall.

- For example, you might purchase bonds with staggered maturity date “rungs” of two years, four years, six years, and eight years. After two years, when your first bond matures, you can determine whether to purchase another eight-year bond to continue the ladder or explore other investment opportunities. Bond ladders also reduce credit risk by decreasing exposure to any single issuer’s creditworthiness, and increase liquidity by providing flexibility and access to cash without having to sell bonds prematurely.

You can also try to mitigate interest rate risk by investing in Treasury Inflation-Protected Securities (TIPS), which are designed to keep pace with inflation. Some investors also use floating-rate securities, which are tied to a benchmark index and regularly reset interest payments, to minimize interest rate risk, although they may have to assume more credit risk.

When investing in bonds, it is essential to remain aligned with your investment objectives, time horizon, and risk tolerance. Additionally, consider the current economic environment and market conditions, as these factors can influence bond performance. Regularly reviewing your investment strategy can help ensure it continues to meet your financial goals.

CRC# 4951914 11/2025

How can E*TRADE from Morgan Stanley help?

Need help getting started with bonds?

To get started with bonds, visit our comprehensive Bond Resource Center. Use our Advanced Screener to quickly find the right bonds for you. Or call our Fixed Income Specialists at (877-355-3237) if you need additional help.

Individual bonds and CDs

Explore over 50,000 bonds from 200+ leading providers. Most bonds and certificates of deposits (CDs) are designed to pay you steady income on a regular basis.