What are bond ratings?

E*TRADE from Morgan Stanley

11/25/25Summary: Bonds are assigned ratings by financial research firms, which gauge the issuer’s creditworthiness. What factors determine these bond ratings, and how can investors use them?

Bond ratings are assigned by private firms and serve as a gauge to determine an issuer’s ability to repay principal and interest payments. A letter-based scoring system is used to help investors understand an issuer’s creditworthiness and how risky the bond may be.

Corporate bond ratings are based on the strength of the corporation issuing the bond, considering such factors as outstanding debt, growth rate, and the broader industry. Government bond ratings, on the other hand, are based on the financial position of the state or city issuing the bond, including growth rates of revenue and spending.

All bond ratings can be affected by the state of the overall economy, whether local, state, or national.

Rating scales

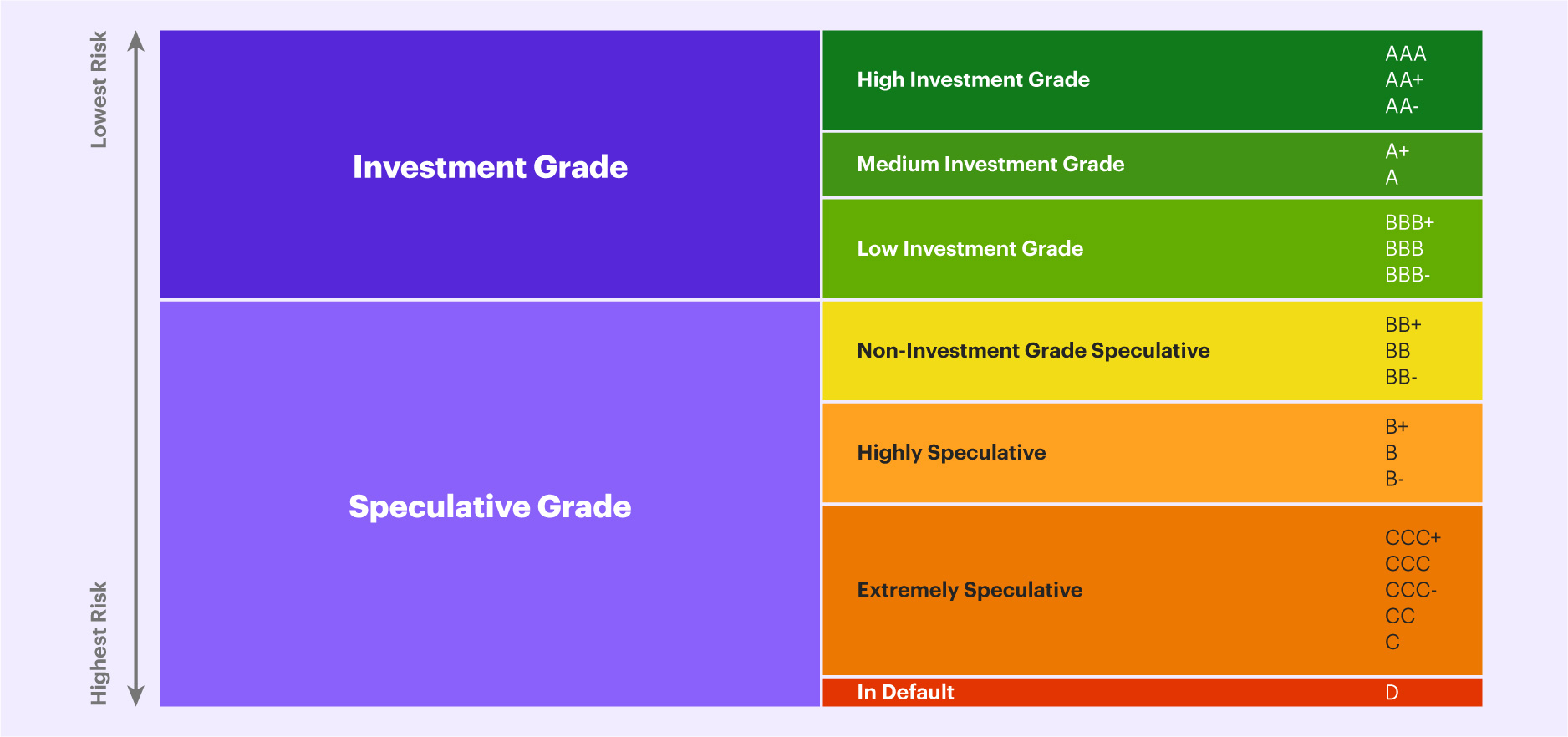

The major rating firms—Moody’s and Standard & Poor’s—use a letter-grade scale. Each then uses modifications to assign rankings within the broader letter grade. Moody’s modifies rankings with numbers while Standard & Poor’s uses plus and minus signs.

Classes of bonds

As seen in the chart above, bonds are generally divided into two classes: Investment-grade and speculative (non-investment grade), commonly referred to as junk or high-yield. Investment-grade bonds are considered lower risk, while non-investment grade are typically seen as speculative and higher risk bonds.

Bond ratings and bond prices

A bond’s rating influences its yield. Companies and governments with lower bond ratings must pay higher interest rates on the debt they issue to attract buyers.

When ratings services change their outlook on an issuer and upgrade or downgrade a bond, the bond’s price can be affected on the secondary market. If the bond is downgraded, its price will typically fall as investors demand a higher yield for the increased risk. Similarly, if a bond is upgraded, its price will usually rise.

For more information, check out the Bond Resource Center where you can use a bond screener to filter bonds by rating or other criteria and access educational bond resources like Moody’s detailed reports.

CRC# 4978080 11/2025

How can E*TRADE from Morgan Stanley help?

Need help getting started with bonds?

To get started with bonds, visit our comprehensive Bond Resource Center. Use our Advanced Screener to quickly find the right bonds for you. Or call our Fixed Income Specialists at (877-355-3237) if you need additional help.