Retirement accounts

Take on your retirement with E*TRADE

Invest for the future with tax-qualified retirement accounts, easy-to-use tools, and a special limited-time cash credit.

Get up to $10,000 for a limited time1

Put our retirement accounts to work for you

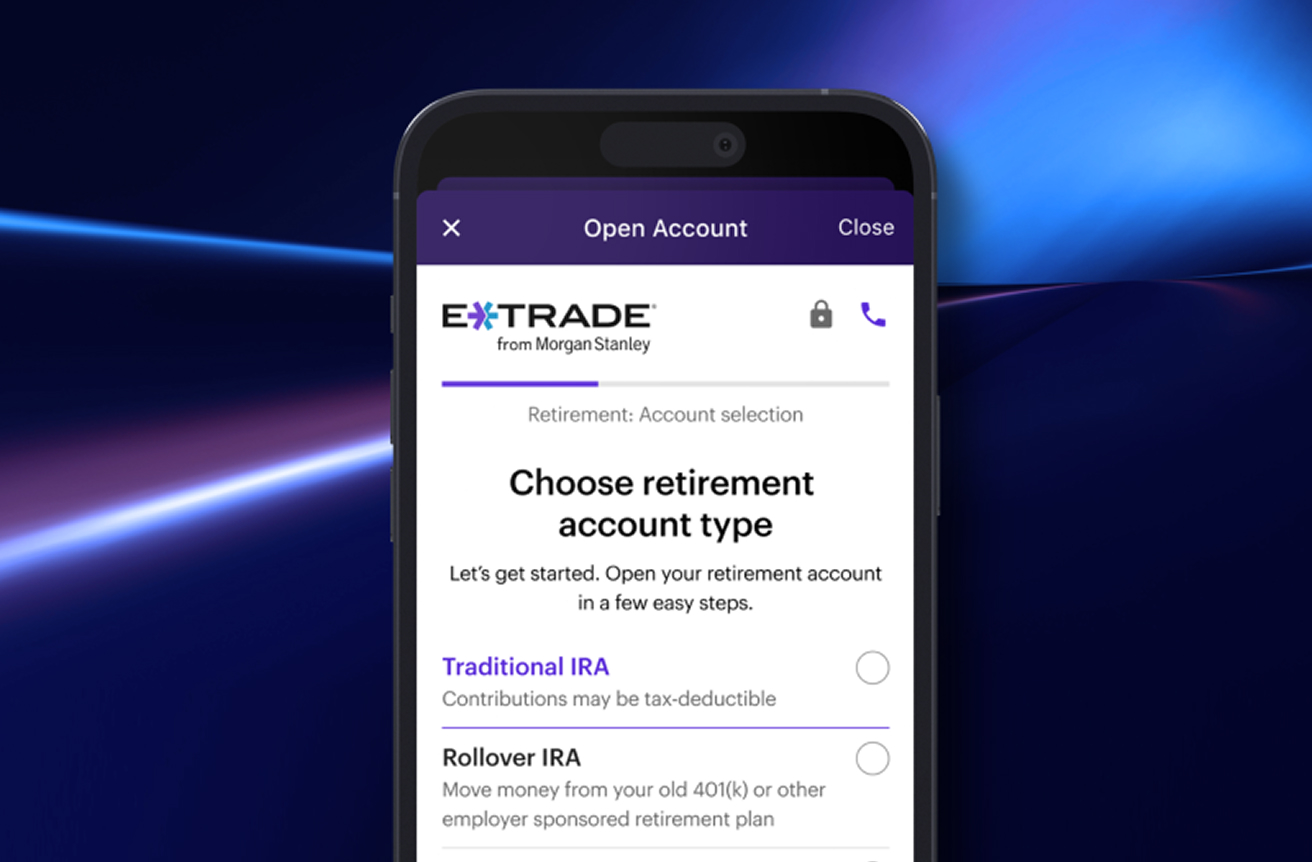

Rollover IRA

Consider moving your 401(k)/403(b)2

IRAs may provide more investment options, lower fees, and greater control while maintaining tax advantages

Traditional IRA

Build your retirement nest egg

An account that has the potential to reduce your taxable income and grow tax-deferred

Roth IRA

Invest after-tax dollars

For tax-free growth potential and tax-free withdrawals if you meet certain requirements3

E*TRADE CompleteTM IRA

Cash management for those over 59½4,5

Inherited IRA

For beneficiaries who inherit retirement accounts

Small business plans

Offer retirement benefits to your employees

Get up to $10,000 cash credit1

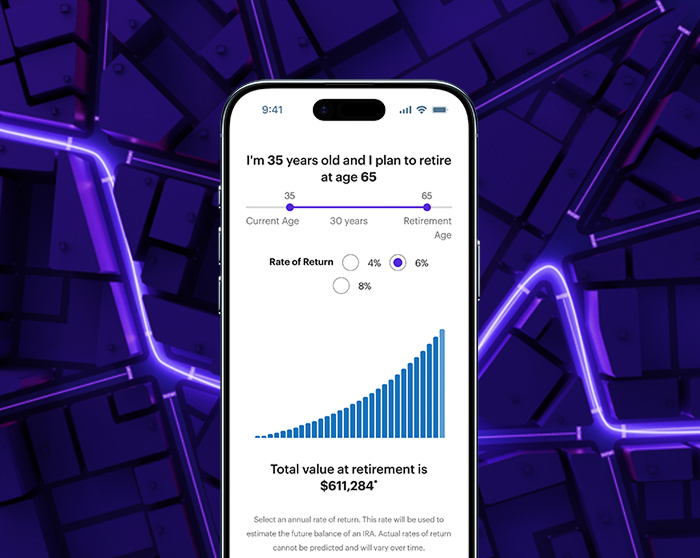

Retirement planning

Invest in tomorrow by starting today

Use our retirement calculator to see how much your savings could potentially grow in a tax-qualified retirement account.

Three reasons to invest with an E*TRADE retirement account

1

Fee-free accounts

Our retirement accounts are free to open and have no maintenance fees. Stock, ETF, mutual fund, and options trades are commission-free, and pricing and rates for advanced trading is competitive. Other fees may apply.6

2

Wide range of offerings

From individual accounts like traditional and Roth IRAs, to niche small-business solutions like SIMPLE and SEP IRAs, we have the right retirement account to help meet your needs.

3

Easy to use

Whether you’re saving for retirement or living it, our accounts are easy to manage online or on the E*TRADE mobile app.

Awards and recognition

E*TRADE Retirement Accounts won 'Best in Class' in Stockbrokers.com 2025 Annual Awards.

Education and resources

Insights to stay informed and inspired

Which IRA could be right for me?

E*TRADE has an IRA that can help you make progress toward your retirement goals.

Four things you should consider before rolling over your 401(k)

IRAs are tax-deferred vehicles that can generally accept a rollover of assets from a qualified retirement plan.

Understanding required minimum distributions (RMDs)

Planning ahead for what you want to do with the money may help reduce taxes and increase options for re-investing.

Frequently asked questions

-

An investor can contribute to an IRA account by transferring funds online from a bank or brokerage account, sending a check, or completing a wire transfer. For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account.

An investor is allowed to contribute 100% of earned income up to the annual contribution limit. View IRA Contribution Limits and Deadlines to learn more.

-

Requesting a distribution online may allow for faster access to funds. Complete the online form to get started. The request should be processed and on its way in 3–5 business days.

-

General:

- Must be 18 years of age or older with taxable compensation

- Must have Modified Adjusted Gross Income (MAGI) under certain thresholds to make tax-deductible contributions if you or your spouse is an active participant in an employer-sponsored retirement plan

- To apply online, you must be a U.S. citizen or resident

- Can open and make a contribution to your Traditional IRA for a tax year at any time during the tax year or by your individual federal tax return filing deadline (not including extensions). This date is generally April 15 of each year. Applications postmarked by this date will be accepted.

- Participation in an employer-sponsored retirement plans, such as a 401(k), 403(b), or 457 plan, may impact your ability to make tax-deductible contributions to your Traditional IRA. If neither you nor your spouse participates in an employer-sponsored plan, you may be able to make a contribution to your Traditional IRA that is fully deductible.

Single Filers:

- If taxpayer participates in an employer-sponsored retirement plan, and taxpayer’s MAGI is $77,000 or less in 2024 (or $79,000 or less in 2025), taxpayer may be eligible to deduct the entire contribution. If taxpayer’s MAGI is more than $77,000 but less than $87,000 in 2024 (or more than $79,000 but less than $89,000 in 2025), taxpayer may be eligible to deduct part of the contribution. Taxpayer is not eligible to make a tax-deductible contribution if MAGI is $87,000 or more in 2024 (or $89,000 or more in 2025).

Joint Filers:

- If taxpayer participates in an employer-sponsored retirement plan, and taxpayer’s MAGI is $123,000 or less in 2024 (or $126,000 or less in 2025), taxpayer may be eligible to deduct the entire contribution. If taxpayer’s MAGI is more than $123,000 but less than $143,000 in 2024 (or more than $126,000 but less than $146,000 in 2025), taxpayer may be eligible to deduct part of the contribution. Taxpayer is not eligible to make a tax-deductible contribution if MAGI is $143,000 or more in 2024 (or $146,000 or more in 2025).

- If taxpayer does not participate in an employer-sponsored retirement plan, but taxpayer’s spouse does, then the MAGI limits are different. If taxpayer’s MAGI is $230,000 or less in 2024 (or $236,000 or less in 2025), taxpayer may be eligible to deduct the entire contribution. If taxpayer’s MAGI is more than $230,000 but less than $240,000 in 2024 (or more than $236,000 but less than $246,000 in 2025), taxpayer may be eligible to deduct part of the contribution. Taxpayer is not eligible to make a tax-deductible contribution if MAGI is $240,000 or more in 2024 (or $246,000 or more in 2025), and taxpayer’s spouse participates in an employer-sponsored retirement plan.

-

General:

- Must be 18 years of age or older with taxable compensation

- Must have Modified Adjusted Gross Income (MAGI) under certain thresholds (see ‘Single Filers’ or ‘Joint Filers’ for additional information). If your MAGI exceeds the MAGI limitations to contribute to a Roth IRA, you can still contribute to a Traditional IRA, but contributions may not be tax-deductible; however, you may still benefit from the potential of tax-deferred growth. Additionally, Traditional IRA assets may be converted to a Roth IRA, but the taxable portion of the converted assets will be subject to ordinary income taxes.

- To apply online, you must be a U.S. citizen or resident

- Can open and make a contribution to your Roth IRA for a tax year at any time during the tax year or by your federal tax return filing deadline (not including extensions). This date is generally April 15 of each year. Applications postmarked by this date will be accepted.

Single Filers:

- If an investor’s MAGI is $146,000 or less in 2024 (or $150,000 or less in 2025), they may be eligible to make a full contribution. If their MAGI is between $146,000 and $161,000 in 2024 (or between $150,000 and $165,000 in 2025), they may be eligible to make a partial contribution. An investor is not eligible to make a contribution if their MAGI is $161,000 or more in 2024 (or $165,000 or more in 2025).

Married, filed jointly:

- If a couple’s combined MAGI is $230,000 or less in 2024 (or $236,000 or less in 2025), they may be eligible to make a full contribution. If their combined MAGI is between $230,000 and $240,000 in 2024 (or between $236,000 and $246,000 in 2025), a couple may be eligible to make a partial contribution. They are not eligible to make a contribution if MAGI is $240,000 or more in 2024 (or $246,000 or more in 2025).

Note: Modified adjusted gross income (MAGI) is used to determine whether an individual qualifies for certain tax deductions or other benefits. Most notably, it is used to determine how much of an individual's IRA contribution is deductible (if the individual or their spouse is covered by a workplace retirement plan) and whether an individual is eligible to contribute to a Roth IRA.