Rally gets “magnificent” boost

- NVDA beats numbers, SPX and NDX hit new highs

- Oil tests resistance, bond yields steady

- This week: Fed inflation, GDP, durable goods, home prices

In a way, last week was a tale of two markets—before Nvidia earnings and after Nvidia earnings.

In a holiday-shortened week, the S&P 500 (SPX) rallied one day, fell one day, and was essentially flat the other two. But Thursday was really the only day that “mattered.” That was the day after AI-centric chipmaker Nvidia (NVDA) released its forecast-topping numbers, helping propel the index to its latest record highs, despite some evidence of fatigue on Friday:

Source: Power E*TRADE. (For illustrative purposes. Not a recommendation. Note: It is not possible to invest in an index.)

The headline: Market pivots on chipmaker’s earnings.

The fine print: Before NVDA released its numbers Wednesday afternoon, the Nasdaq 100 (NDX) tech index was down 1.2% for the week. On Thursday, NVDA rallied 16.4%, and both the NDX and SPX posted their biggest up days (+3% and +2.1%, respectively) in more than year.

The moves: The fact that the NDX trailed the SPX last week highlights NVDA didn’t tell the entire tech story. On Wednesday, for example, Palo Alto Networks (PANW) fell 28% to $261.97—the biggest down in its history—before bouncing to end the week at $282.09.

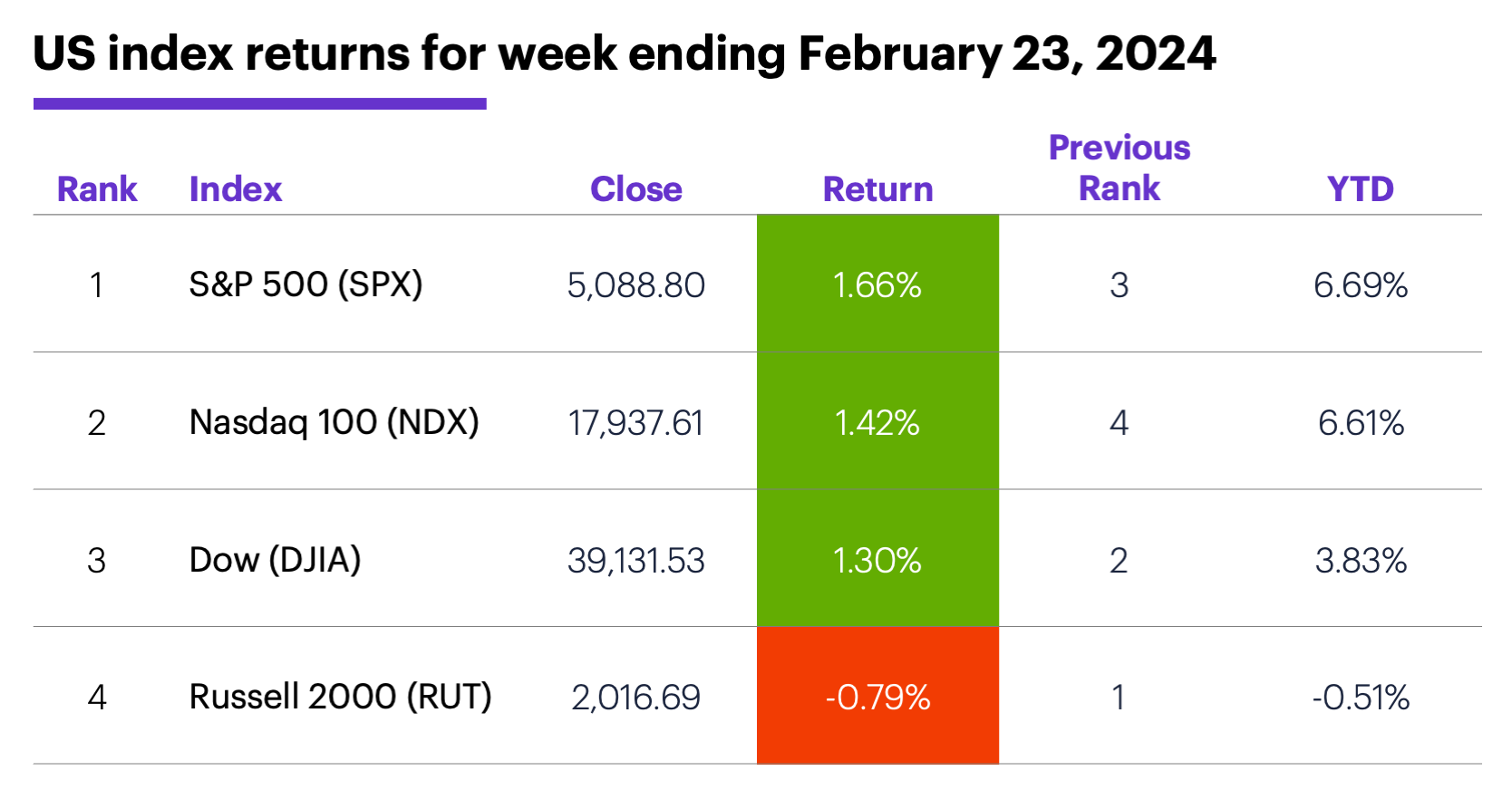

The scorecard: All the major indexes were positive for the week, except for the small cap Russell 2000 (RUT), which slipped back into negative territory for the year:

Source (data): Power E*TRADE. (For illustrative purposes. Not a recommendation.)

Sector returns: The strongest S&P 500 sectors last week were materials (+1.3%), consumer staples (+2.4%), and health care (+2.4%). The weakest sectors were real estate (-0.04%), communication services (unchanged), and energy (+0.4%).

Stock movers: On Thursday, Root (ROOT) +53% to $13.29, and Mativ (MATV) +43% to $16.78. On the downside, Rapt Therapeutics (RAPT) -74% to $6.87 on Tuesday (then +48% to $10.18 on Wednesday), Bel Fuse (BELFB) -29% to $50.02 on Thursday.

Futures: May cocoa (CCK4) outgained all futures markets for a second week in a row as cocoa prices continued to hit record highs. Continuing to consolidate at its multi-month resistance level, April WTI crude oil (CLJ4) ended last week lower at $76.58 after a sharp pullback on Friday. April gold (GCJ4) closed Friday at a two-week high of $2,046.40. Week’s biggest rallies: May cocoa (CCK4) +11.6%, May orange juice (OJK4) +4.6%. Week’s biggest declines: April heating oil (HOK4) -4.6%, May oats (ZOK4) -4.3%.

Coming this week

Traders will get a look at the Fed’s preferred inflation gauge (the PCE Price Index), along with updated Q4 GDP data and durable goods orders:

●Monday: New Home Sales

●Tuesday: Durable Goods Orders, S&P Case-Shiller Home Price Index, FHFA House Price Index, Consumer Confidence

●Wednesday: Q4 GDP (second estimate), Trade Balance in Goods (advance), Retail and wholesale inventories (advance), Chicago PMI

●Thursday: Personal Income and Spending, PCE Price Index, Pending Home Sales

●Friday: S&P Global Manufacturing PMI, ISM Manufacturing Index, Consumer Sentiment, Construction Spending

This week’s earnings include:

●Monday: SBA Communications (SBAC), Workday (WDAY), Zoom Video Communications (ZM)

●Tuesday: AutoZone (AZO), Shift4 Payments (FOUR), Lowe's (LOW), J.M. Smucker (SJM), Agilent (A), eBay (EBAY), First Solar (FSLR), Boston Beer (SAM), Splunk (SPLK), Urban Outfitters (URBN)

●Wednesday: Advance Auto Parts (AAP), B. Riley Financial (RILY), Squarespace (SQSP), TJX (TJX), C3 AI (AI), Salesforce (CRM), Duolingo (DUOL)

●Thursday: Best Buy (BBY), Anheuser Busch InBev (BUD), Burlington Stores (BURL), Kroger (KR), Autodesk (ADSK), Dell Technologies (DELL), Hewlett Packard Enterprise (HPE)

Check the Active Trader Commentary each morning for an updated list of earnings announcements, IPOs, economic reports, and other market events.

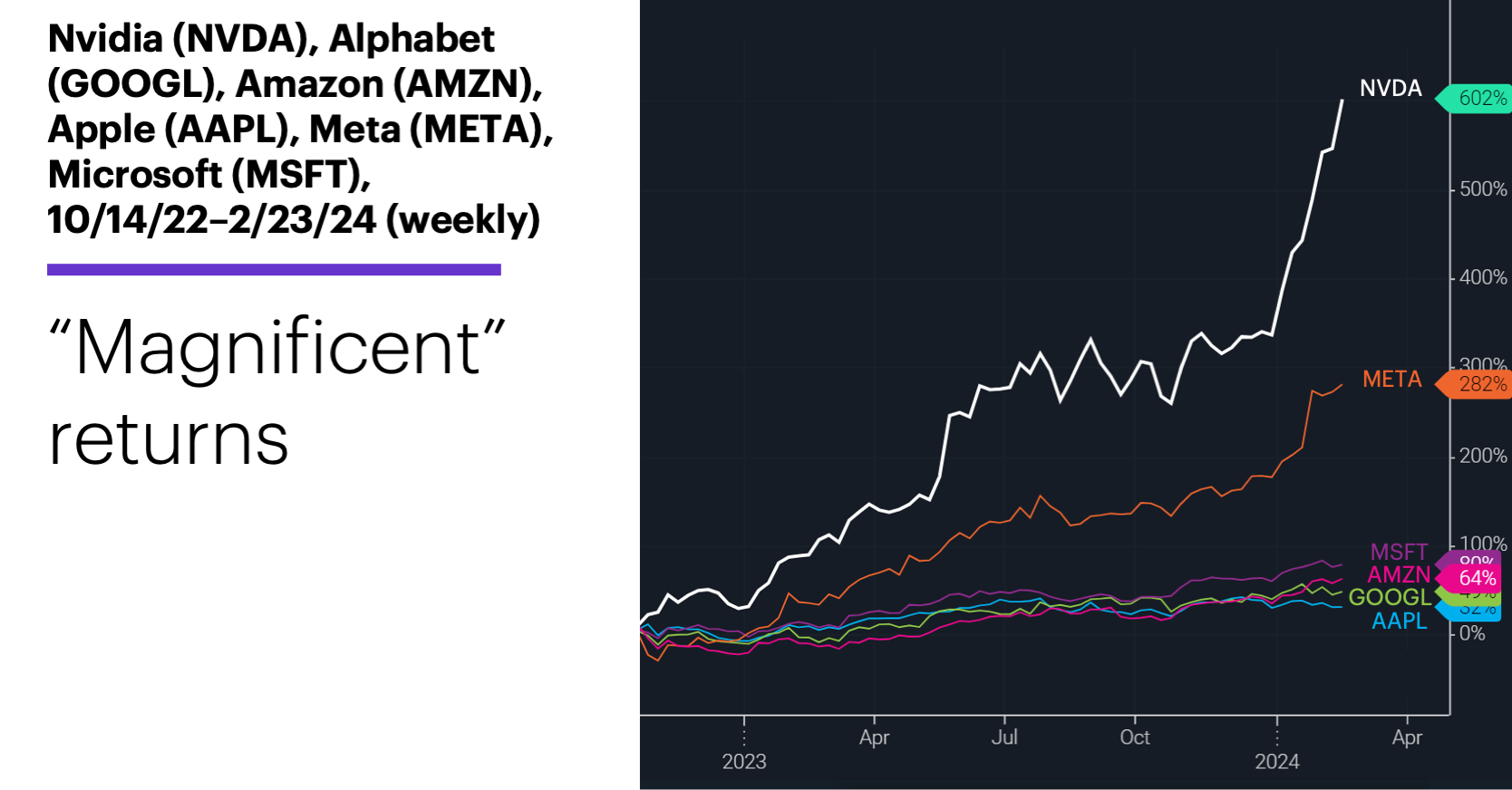

The magnificent one

There’s been a good deal of discussion about the implications of a handful of stocks generating the majority of the market’s overall gains, but lately that handful has looked more like a single digit.

Who knows what the next iteration market-leading stocks will be called, but for most of the past year or so it was the “Magnificent Seven”—Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA). Beyond the fact that TSLA’s demotion from the club has left it with only six members, the following chart suggests that since late 2022, a more accurate description may be “The Magnificent One & Friends:”

Source (data): Power E*TRADE. (For illustrative purposes. Not a recommendation.)

While Nvidia’s earnings announcement last Thursday was arguably the headline event of the trading week, the 16.4% rally that followed it was just icing on the stock’s cake. In the 72 weeks since October 14, 2022, NVDA more than doubled the return of its nearest competitor (META), and gained more than 10 times as much as either AAPL or GOOGL.1 (In fairness, it’s been more of a NVDA–META horse race if measuring returns from mid-November 2022.)

This wasn’t even NVDA’s biggest 72-week return, though. The stock gained 810% in the same span ending September 29, 2000. And among these six stocks, AMZN holds the record, with a 3,326% return for the 72 weeks ending January 8, 1999. Both of these gains, however, occurred in the first couple of years after the stocks went public. Over the past decade, no other stock in the group has come close to NVDA’s performance in a 72-week period.

Click here to log on to your account or learn more about E*TRADE's trading platforms, or follow the Company on X (Twitter), @ETRADE, for useful trading and investing insights.

1 All figures reflect weekly closing prices, 1997–2024. Supporting document available upon request.