Investing should be this easy

Straightforward tools, no account minimums and a range of investment choices.

Get up to $1,000 for a limited time1

Open and fund a new brokerage account with a qualifying deposit by 10/31/25. Terms apply. Use promo code: OFFER25

Low fees, wide range of investments

$1.50

Futures

Per contract, per side + fees (excluding cryptocurrency futures)5

Get up to $1,000 for a limited time1

Open and fund a new brokerage account with a qualifying deposit by 10/31/2025. Terms apply.

Use promo code: OFFER25

Three reasons to invest with an E*TRADE brokerage account

1

Wide range of investments

Explore a wide range of investment choices—including stocks, ETFs, options, mutual funds, bonds, futures, and initial public offerings (IPOs).

2

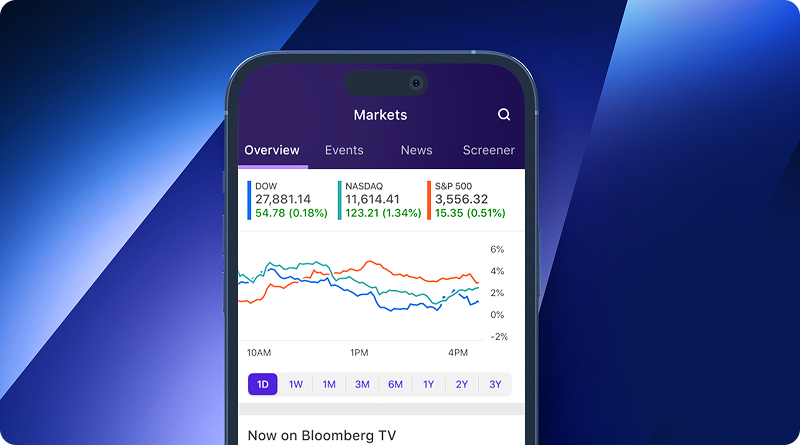

Best-in-class mobile trading

Seize potential opportunities virtually anytime and anywhere with our award-winning desktop platform and mobile app.6

3

Investing insights and ideas

Stay ahead with in-depth research and analysis from Morgan Stanley experts.

Power E*TRADE Pro

Advanced trading at your fingertips

Experience the ultimate downloadable desktop trading platform with nearly unlimited customization, advanced charting and more.Awards and recognition

E*TRADE recognized in Nerdwallet's "Best Brokerage Accounts for Online Stock Trading" review.

Education and resources

Insights to stay informed and inspired

Am I financially ready to start investing?

Investing can be a great way to put your hard-earned money to work for you.

Why consider investing in index mutual funds?

Index mutual funds can give you a simple, low-cost way to diversify your portfolio.

Growth vs. value investing

Discover how incorporating either or both strategies can potentially enhance and diversify your portfolio.

What is dollar-cost averaging?

Dollar-cost averaging offers a balanced approach to entering the markets.

Frequently asked questions

-

Think of a brokerage account as our standard investing account. Once your account is open, you can deposit funds that you can then use to invest or trade in the markets. E*TRADE from Morgan Stanley offers you a wide range of investment choices, including stocks, bonds, mutual funds, ETFs (including crypto exchange traded products), options, futures, and more.

-

You can open a brokerage account in about 10 minutes online, by phone, or through the mail.

Online

- Choose the type of account you want. Then complete our E*TRADE from Morgan Stanley brokerage or Morgan Stanley Private Bank online application.

- For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit.

By Phone

Call 800-387-2331

By Mail

- Download an application and then print it out.

- Complete and sign the application.

- Send the application with a check made payable to E*TRADE from Morgan Stanley or Morgan Stanley Private Bank (depending on the type of account you're opening) to the appropriate address.

-

When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also utilize a third-party information provider for verification purposes and/or ask for a copy of your driver’s license or other identifying documents.

-

Choose the method that works best for you:

- Transfer money electronically: Use our Transfer Money service to transfer within 3 business days.

- By check: You can easily deposit many types of checks.

- By wire transfer: Wire transfers are fast and secure.

- Transfer an account: Move an account from another firm.

- Direct deposit: Automatically deposit your paycheck and other recurring income to your Morgan Stanley Private Bank checking or savings accounts or your E*TRADE brokerage account.

Go now to fund your account.

-

Consolidating your assets at E*TRADE is easy. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process.

Transfer a brokerage account in three easy steps:

- Open an account in minutes.

- Request an Electronic Transfer or mail a paper request.

- Full brokerage transfers submitted electronically are typically completed in ten business days.

Paper/mail requests for account transfers generally take three to six weeks, depending on how quickly the delivering financial institution is able to process your transfer request.

We'll send you an online alert as soon as we've received and processed your transfer.

Transfer an existing IRA or roll over a 401(k):

- Open an account in minutes.

- Request an Electronic Transfer or mail a paper request.

- Full brokerage transfers submitted electronically are typically completed in ten business days.

Paper/mail requests for account transfers generally take three to six weeks, depending on how quickly the delivering financial institution is able to process your transfer request.

We'll send you an online alert as soon as we've received and processed your transfer.

Go now to move money.

-

Our E*TRADE Mobile App lets you seamlessly connect with the markets and your accounts from anywhere. Seize opportunities anytime, anywhere with our full-featured mobile trading app built from the ground up for traders and investors on the go.

-

Morgan Stanley Smith Barney LLC is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org.