The growing demand for LGBTQ+ investment options

Morgan Stanley Wealth Management

04/19/24Summary: A growing population of investors who ally with the LGBTQ+ community plus generational shifts in wealth are creating demand and opportunities for investments that support LGBTQ+ equity and inclusion.

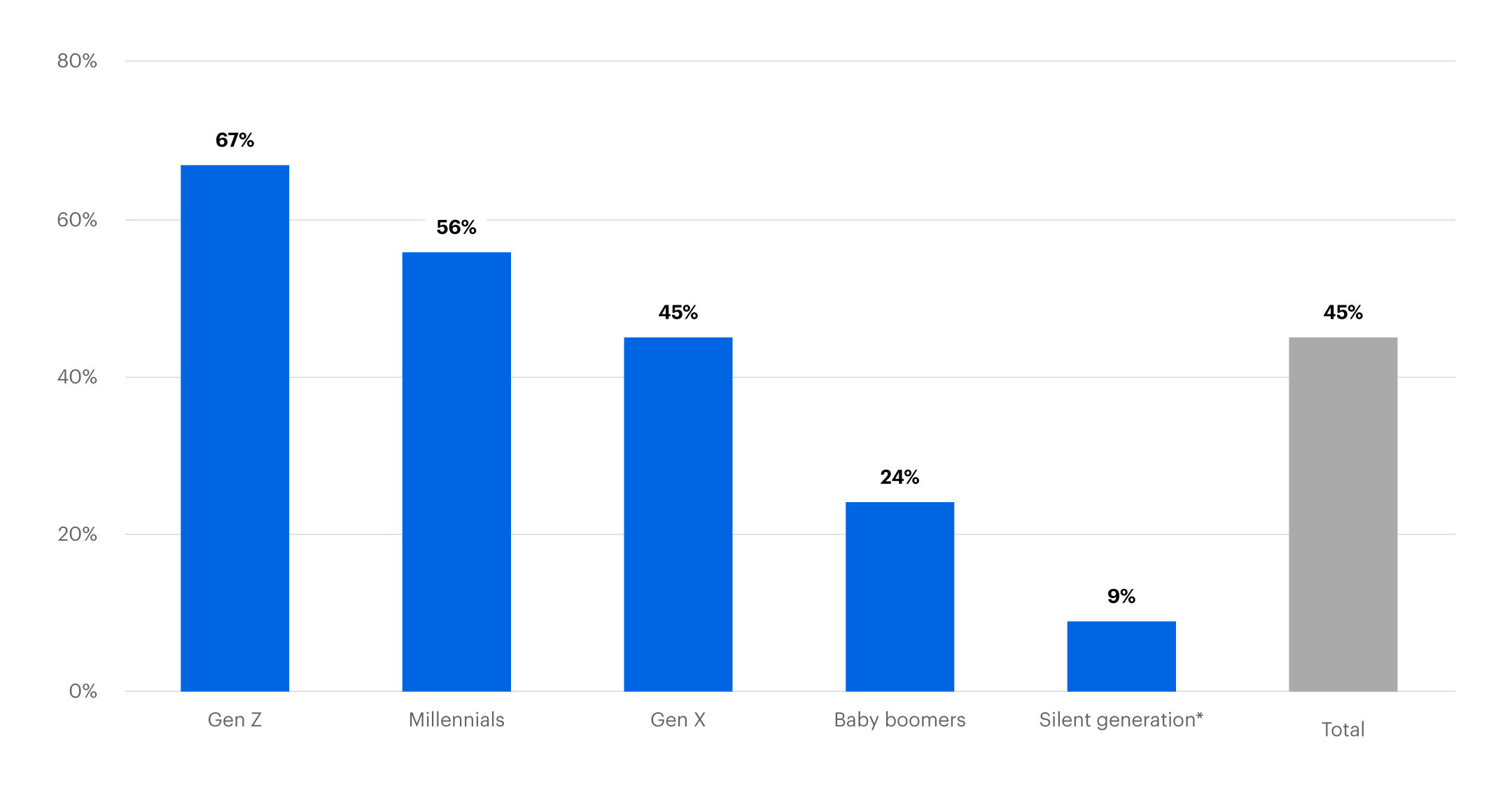

Nearly half of US investors in a recent Morgan Stanley survey want opportunities to invest in LGBTQ+1 equity and inclusion, across a broad range of products and strategies. This demand increases substantially among LGBTQ+ investors (86%), heterosexual2 investors with an LGBTQ+ household member (76%) and younger investors (67% of Gen Z and 56% of Millennials).

The market for investments advancing LGBTQ+ equity & inclusion

Although the LGBTQ+ community in the US is growing, with 26 million people representing 8% of adults overall and 21% of Gen Z adults,3 individuals still face social and economic disparities. Half of LGBTQ+ workers report that they have experienced workplace discrimination4 and LGBTQ+ founders have raised just 0.5% of venture capital in the US.5

Investor capital could act as a lever to address such inequities. “Investing with LGBTQ+ objectives describe the effort to direct investment capital toward the advancement of populations historically disadvantaged based on their sexual orientation or gender identity,” says Susan Reid, Morgan Stanley’s Global Head of Talent and Director of the Institute for Inclusion. “The goal is to advance equitable and inclusive opportunities for the LGBTQ+ community, while also delivering market-rate financial returns.”

The goal is to advance equitable and inclusive opportunities for the LGBTQ+ community, while also delivering market-rate financial returns.

The business case for LGBTQ+ investment products includes both investors who identify as part of that community as well as younger investors: Investors born after 1980, regardless of their identity, could play a significant role in demand for these products (see Figure 1). As older generations transfer wealth to their heirs in the coming decades, $73 trillion is predicted to move to investors more interested in products and strategies advancing LGBTQ+ equity.6 This generational wealth transfer could drive demand growth by boosting the assets of those interested in LGBTQ+ equity investing by more than 40%.7

Figure 1: Demand was Higher Among Younger Respondents

How interested are you in finding investment products or strategies that seek to advance LGBTQ+ equity and inclusion?

Age ranges: Gen Z: 18-26, Millennials: 27-42, Gen X: 43-58, Baby Boomers: 59-77, Silent Generation: 78-80. Respondents who answered Very or Somewhat Interested. *Denotes a small sample size.

Meeting the opportunity

Despite this investor interest, investment options today are limited. Here are four potential opportunities investors can consider:

- Look for specific investments that advance LGBTQ+ equity. Approximately 87% of interested investors reported demand for investing in companies that have efforts to promote a culture of LGBTQ+ inclusion through employee policies, practices, and representation. E*TRADE’s Diversity and Inclusion theme offers ETFs that focus in these areas.

- Influence companies to make changes. Investors can help drive change through active ownership, in which shareholders directly influence a company’s strategies or actions. Investors can engage with companies in their portfolio to potentially evolve corporate behavior through the form of industry coalitions and advocacy by voting on certain corporate actions during company’s annual meetings.

- Think about philanthropic giving. Another option is giving to organizations with the primary mission of advancing LGBTQ+ equity, or major programming dedicated to the LGBTQ+ community.

- Evaluate financial services companies and Financial Advisors who are supportive of LGBTQIA issues. If you’re considering a Financial Advisor, check to see if they align with your diversity and inclusion values, including socially responsible investing and environmental sustainability investing.

Approximately 87% of interested investors reported demand for investing in companies that have efforts to promote a culture of LGBTQ+ inclusion through employee policies, practices, and representation. E*TRADE’s Diversity and Inclusion theme offers ETFs that focus in these areas.

The bottom line is the opportunities for LGBTQ+ investments are growing in demand. Although investors’ options for getting involved are a bit limited now, there are several ways to meet the opportunity like active ownership in companies, and even philanthropic giving.

The source of this article, The Growing Demand for LGBTQ+ Investment options, was originally published on June 20,2023.

1 Morgan Stanley uses the term ‘LGBTQ+’ to reflect those who identify as lesbian, gay, bisexual, transgender, and queer, with the ‘+’ including other non-cisgender and/or non-straight identities, such as pansexual, asexual, intersex, gender non-binary, and those questioning their gender and/or sexual identities.

2 Refers to respondents who self-identified as straight/heterosexual.

3 Lydia Anderson, et al., “New Household Pulse Survey Data Reveals Differences between LGBT and Non-LGBT Respondents During COVID-19 Pandemic,” Nov. 4, 2021, US Census Bureau.

4 UCLA School of Law, “LGBT People’s Experiences of Workplace Discrimination and Harassment,” September 2021.

5 The Start Out Index, “Fueling the debate through thought leadership and research,” August 2023.

6 Cerulli Associates, ”Cerulli anticipates $84 trillion in wealth transfers through 2045,” Jan. 30, 2023.

7 The methodology to arrive at these calculations was as follows: The U.S. Federal Reserve’s data on wealth splits by generation was applied to Insider Intelligence’s figure of $58trn for 2020 US Wealth Managers’ AUM. Responses by generation in Figure 5 of the report were then used to calculate the $20trn number. Cerulli’s estimates for generational wealth transfer were then applied to create a post-generational transfer split of AUM, and the same responses in Figure 5 of the report by generation were used to calculate a post transfer AUM figure. The generational wealth transfer was the only new variable: this does not assume any underlying growth in AUM or any increase in demand for investments serving LGBTQ+ equity and inclusion.

How can E*TRADE help?

Diversity, Equity, and Inclusion

To better align investments with your personal values, find companies that may be leaders in equitable hiring, advancement and equal pay.

Brokerage account

Investing and trading account

Buy and sell stocks, ETFs, mutual funds, options, bonds, and more.

Core Portfolios

With Core Portfolios, we'll build, manage, and rebalance a diversified ETF portfolio for you. And we can help you invest in socially responsible companies too.