Does ethnic diversity on corporate boards affect stock prices?

Morgan Stanley Investment Management

01/19/22Summary: A new study from Calvert, part of Morgan Stanley Investment Management, examines whether racial and ethnic board diversity can have a positive effect on stock performance.

Diversity in corporate hiring has become more than a social imperative. Today, many companies see workforce diversity as a strategy to help attract and retain talent, enhance intellectual capital, and drive long-term value creation.

But how does diversity in the boardroom affect financial performance? A new study by Calvert Research and Management, part of Morgan Stanley Investment Management, has some answers.

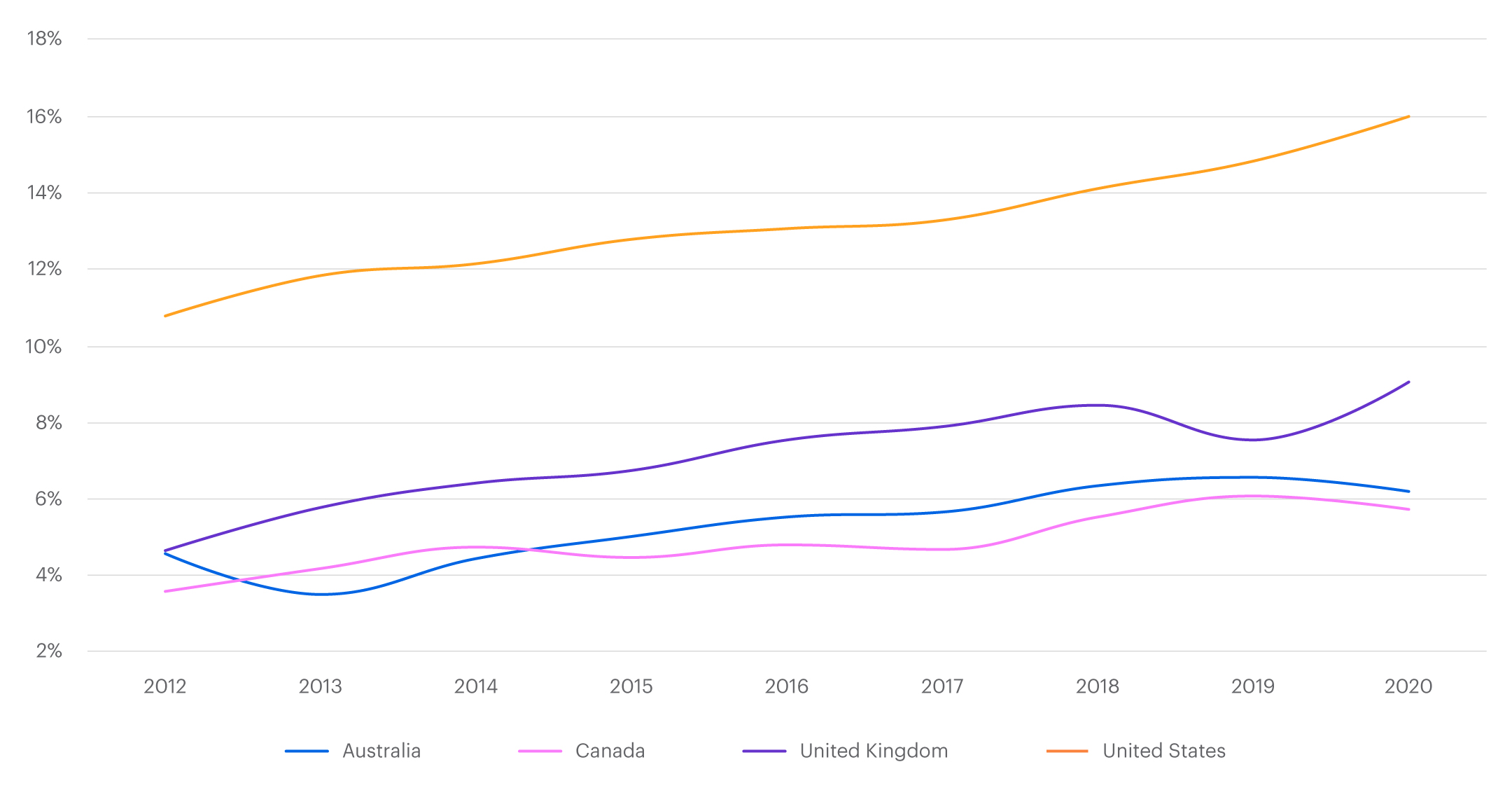

According to the study, which analyzed more than 800 large-cap companies in the United States, United Kingdom, Canada, and Australia from 2012 to 2020, companies with greater board diversity may in fact be better stock picks.

The research suggests that using racial and ethnic board diversity factors can improve US large-cap equity stock selection. In fact, there may be additional benefit in tilting toward more diverse companies across all four developed markets.

Boardroom ethnic diversity and financial performance

For US companies, the study found, racial and ethnic diversity on the corporate boards of large-caps had a significant positive impact on stock price: The difference in returns between stocks of companies with the highest number of people of color on their boards and those with the least was 1.5%. Calvert measured stock prices using the MSCI’s Gross Total Returns database, which includes dividends, and the returns were calculated on a monthly basis, then annualized.

Less significant was the relationship between board ethnic diversity and stock prices for Australian, Canadian, and British companies. While these countries are less diverse than the US and their boards are relatively less diverse, other factors may be at play. Key differences among these economies may have contributed to the disparity, the study found, noting that “the American economy is relatively more reliant on talent and innovation, which will provide equal opportunities for individuals of diverse backgrounds, while a large portion of the Australian and Canadian economies remain natural resources-based.”

Average percentage of people of color on corporate boards by country: 2012-2020

The study’s findings contribute to growing data on the positive performance of environmental, social, and governance (ESG) practices, of which diversity is a key part. Though lingering concerns about returns remain the biggest barrier to widespread sustainability investing, according to a recent report from the Morgan Stanley Institute for Sustainable Investing, 80% of investors still believe that companies with strong ESG practices can generate higher returns and make better long-term investments.1

As demand for sustainable investing continues to grow, investors should engage corporations about their diversity initiatives, not only to help optimize the bottom line but to push the envelope in creating a more equitable future, the Calvert report says.

The source of this Morgan Stanley article, “Does Ethnic Diversity on Corporate Boards Affect Stock Prices?” was originally published on January 5, 2022.

Source of Data: Calvert Research & Management. Date of Data: July 15, 2021. For the complete content and important disclosures, refer to the white paper, “Does an Ethnically Diverse Board Mean Better Stock Performance?,” here.

- Morgan Stanley Institute for Sustainable Investing, “Sustainable Investing Weathers Economic Uncertainty,” 10/27/21

Calvert Research and Management (Calvert) is part of Morgan Stanley Investment Management, the asset management division of Morgan Stanley. A global leader in Responsible Investing, Calvert sponsors one of the largest and most diversified families of responsibly invested mutual funds, encompassing active and passively managed equity, income, alternative and multi-asset strategies. With roots in Responsible Investing back to 1982, the firm seeks to generate favorable investment returns for clients by allocating capital consistent with environmental, social and governance best practices and through structured engagement with portfolio companies.

How can E*TRADE help?

Thematic Investing

Find ETFs that align with your values or with social, economic, and technology trends.

Core Portfolios

With Core Portfolios, we'll build, manage, and rebalance a diversified ETF portfolio for you. And we can help you invest in socially responsible companies too.

All-Star Mutual Funds

Choose from a list of mutual funds, selected by Morgan Stanley Smith Barney, LLC.