Understanding IRA rollovers

E*TRADE from Morgan Stanley

02/28/19If an investor is considering moving assets from one retirement account to another, it is important to understand the rollover process and the rules associated with it. This article will discuss rollover basics as well as rules associated with rollovers. Generally, a rollover is a tax-free transfer of assets from one retirement plan to another. Rollovers are permitted between most tax-qualified retirement accounts and typically do not result in income taxes or tax penalties to the account owner if rollover rules are followed. When considering a rollover, it is important to understand the difference between a direct and an indirect rollover.

Direct rollover

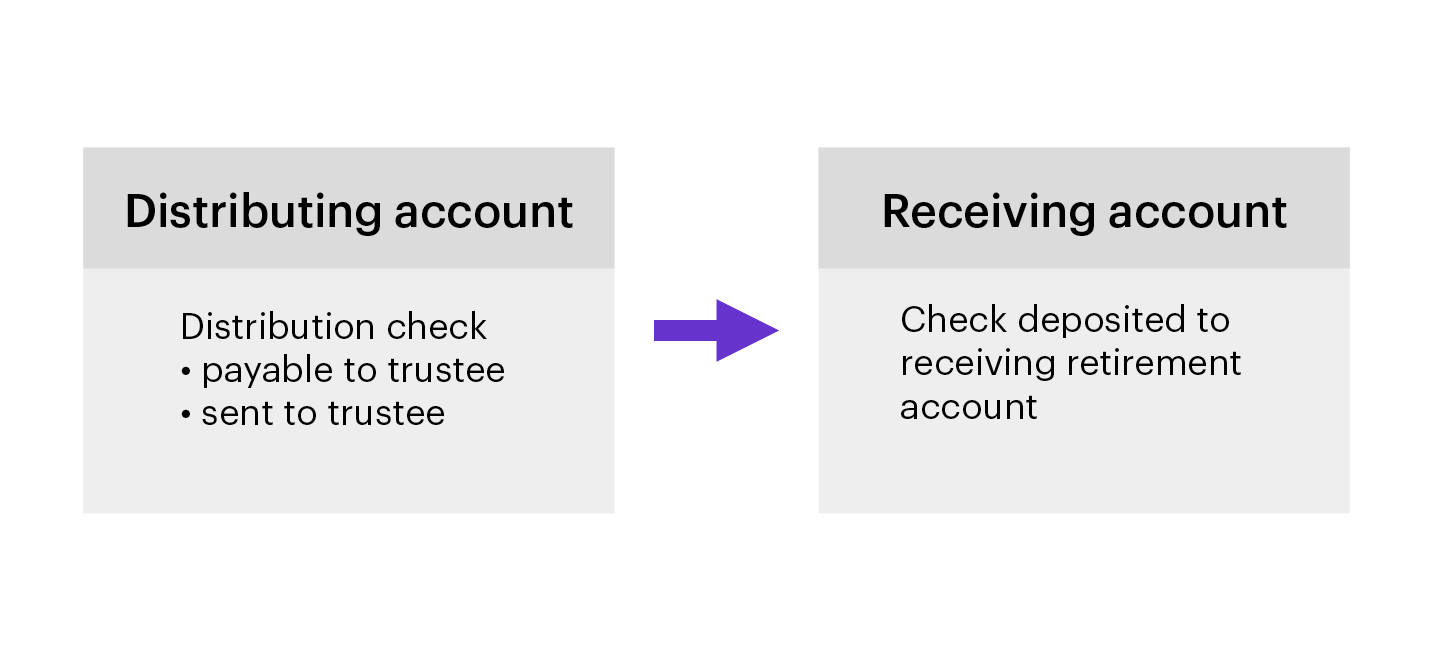

A direct rollover is the easiest way to move money between retirement accounts. With a direct rollover, a distribution check is made payable to the new trustee/custodian, for the benefit of the account owner's new retirement account or plan. Since there is no distribution to an account holder, a direct rollover is not a taxable event, meaning no taxes are paid on the amount that was rolled over at the time of the rollover.

Direct rollover illustration

Indirect rollover

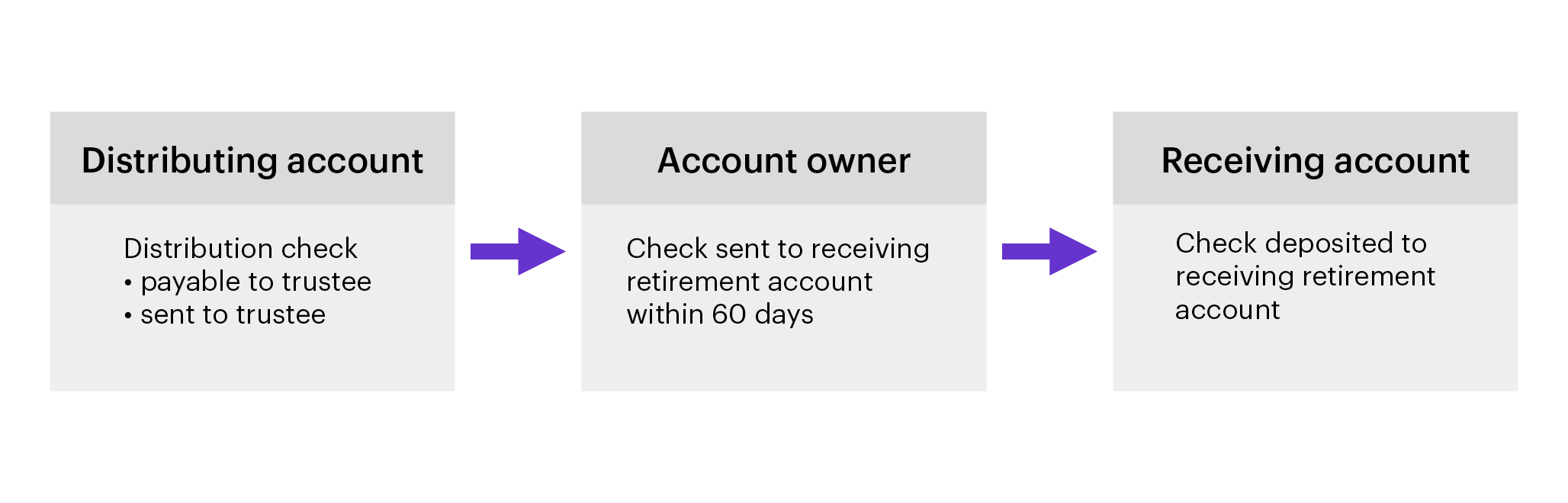

Another option to move assets between retirement accounts is using an Indirect Rollover. With an indirect rollover, the distribution amount is made payable to the retirement account owner. It is then the account holder’s responsibility to deposit these assets into a receiving retirement account. The deposit of assets must occur no later than the 60th day after receipt of the distribution. Any amount that is not deposited within that time period will be subject to income tax (and the 10% distribution penalty tax if under age 59 ½).

Indirect rollover illustration

It is important to note that, in general, if an indirect rollover comes from a qualified retirement plan (such as a 401(k) plan) only 80% of the distribution amount will be paid to the account owner. 20% of the taxable distribution amount will generally be withheld for federal income taxes. The good news is that an investor can avoid tax liability on the 20% withholding if an amount equal to the distribution is deposited, plus the 20% that was withheld. In other words, if the rollover account is funded with 100% of the distribution, taxes will not be paid on the 20% that was withheld and a refund for 20% will occur in the form of a tax credit when a tax return is filed.

Note: if state withholding was applied, that amount must also be deposited into the account.

Whether an investor chooses a direct or indirect rollover method to move assets, it is important to keep in mind that the IRS permits only one indirect rollover between IRAs in any 12-month period. The 12 month rule is based on when an account holder receives the distribution and this time period is not determined on a calendar year basis. This rule applies to all types of IRAs, including Traditional IRAs, Roth IRAs, SEP IRAs and SIMPLE IRAs.

Example: assume an investor owns three IRA accounts: Traditional IRA1, Traditional IRA2 and a SEP IRA. If the investor rolled assets over from the SEP IRA to IRA1 this month, they would need to wait 12 months before they can make another rollover from any of their three IRA accounts, including the IRA1 that received the rollover.

Exceptions to the rule: the one-per-year rollover limit does not apply to the following transactions:

- Rollovers from an employer-sponsored plan, such as a 401(k) or 403(b), to an IRA

- Rollovers from a Traditional IRA to a Roth IRA (Roth conversions)

- Trustee-to-trustee transfers between IRAs (discussed below)

Whether an investor chooses a direct or indirect rollover method to move assets, it is important to keep in mind that the IRS permits only one indirect rollover between IRAs in any 12-month period.

Trustee-to-trustee transfers

A trustee-to-trustee transfer is a transfer of funds from one trustee directly to another. Unlike rollovers, trustee-to-trustee transfers are not allowed between different retirement account types. For example, an investor is not allowed to transfer assets from a 401(k) to an IRA, but an IRA to an IRA transfer is permitted.

Trustee-to-trustee transfers are not taxable at the time of the transfer, since there is no distribution to the account owner and they are exempt from one-rollover-per-year rule for IRA to IRA rollovers, since they are not considered rollovers.

To get further help understanding the above options or all options available with a former employer’s plan, feel free to call 800-387-2331 for step-by-step assistance with rollovers or transfers.