Market tests October lows

- Market retreats as interest rates climb

- 10-year yield hits 4.99%, gold extends rally

- This week: GDP, Fed inflation, durable goods

As traders get ready for a busy week of earnings and the first look at Q3 GDP, the stock market will try to bounce back from one of its largest weekly losses since March.

Despite hitting its highest level in nearly a month last Tuesday, the S&P 500 (SPX) ended the week with its lowest close since the beginning of June amid surprisingly strong economic data and rising interest rates:

Source: Power E*TRADE. (For illustrative purposes. Not a recommendation. Note: It is not possible to invest in an index.)

The headline: Stocks snap two-week win streak.

The fine print: Despite a big week of earnings, the market story continued to revolve around hotter-than-anticipated economic data—including a retail sales print that more than doubled estimates—and the higher-for-longer interest rates that data implies.

The number: 198,000, the number of new jobless claims reported last Thursday—the lowest total since January.

The move: The benchmark 10-year T-note yield reached 4.99% last Thursday, as close to 5% as it has been since July 2007.

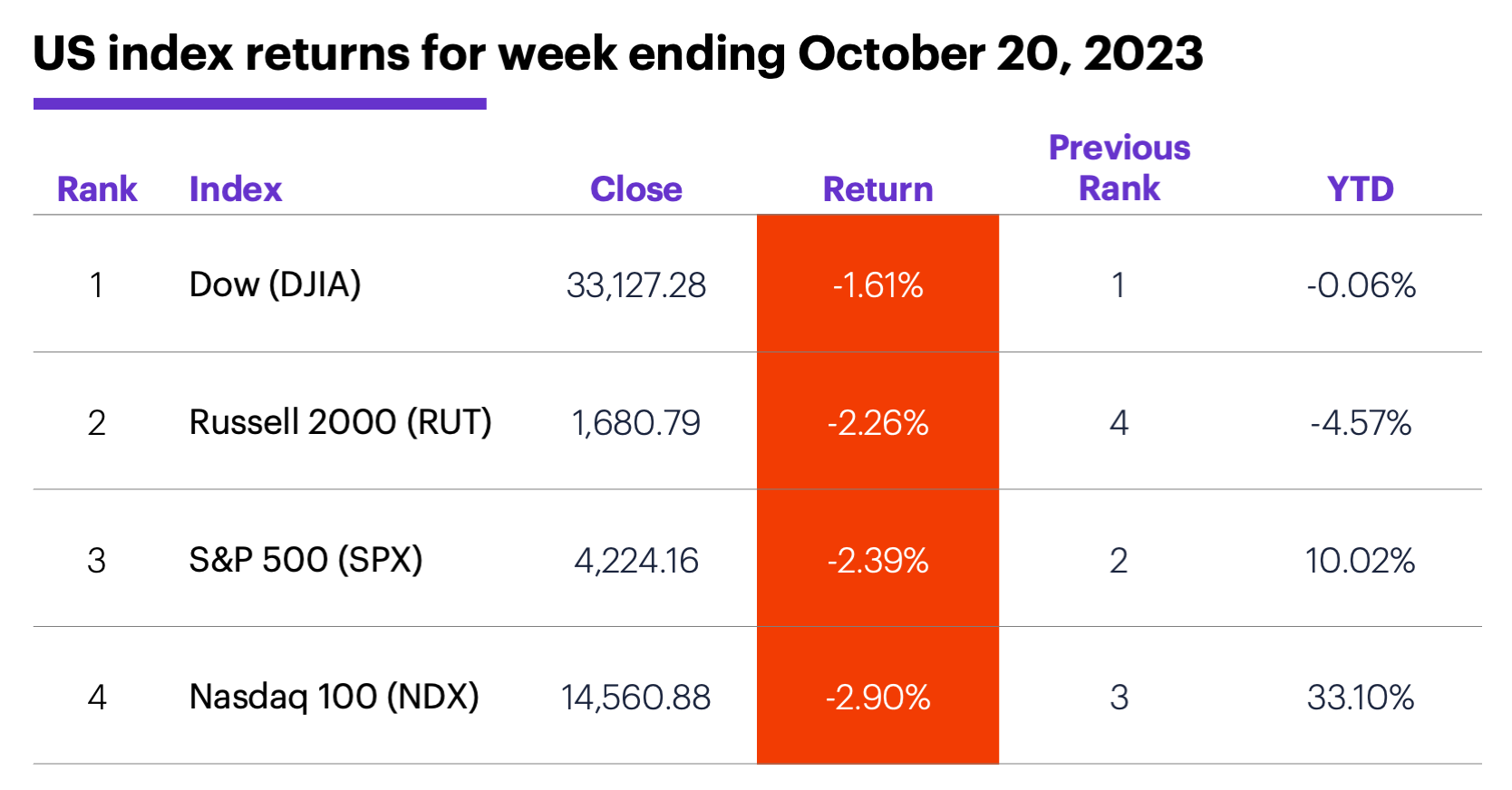

The scorecard: The Dow Jones Industrial Average (DJIA) took the smallest loss last week, but it also joined the Russell 2000 (RUT) in negative territory for the year:

Source (data): Power E*TRADE. (For illustrative purposes. Not a recommendation.)

Sector returns: The strongest S&P 500 sectors last week were consumer staples (+0.7%), energy (+0.7%), and communication services (-0.5%). The weakest sectors were real estate (-4.6%), consumer discretionary (-4.5%), and information technology (-3.1%).

Stock movers: On Monday Prothena (PRTA) +19% to $52.32, Netflix (NFLX) +16% to $401.77 on Thursday. On the downside, Vista Outdoor (VSTO) -24% to $25.02 on Monday, SolarEdge Technologies -27% to $82.90 on Friday.

Futures: December gold (GCZ3) topped $2,000 intraday on Friday before ending the day at $1,994.40, its highest close since July 31. December WTI crude oil (CLZ3) rallied for a second-straight week, closing Friday $88.08. Week’s biggest gains: October Micro bitcoin (MBTV3) +10.6%, December soybean meal (ZMZ3) +8.7%. Week’s biggest losses: December natural gas (NGZ3) -9.1%, December Ultra T-bond (UBZ3) -5.2%.

Coming this week

It’s a “big” week of earnings, with many big tech, big pharma, big consumer, and big oil names releasing their numbers. Here’s a sample:

●Monday: Cleveland-Cliffs (CLF), Medpace (MEDP)

●Tuesday: General Electric (GE), General Motors (GM), Halliburton (HAL), Kimberly-Clark (KMB), Spotify (SPOT), Verizon (VZ), Alphabet (GOOGL), Microsoft (MSFT), Snap (SNAP), Visa (V)

●Wednesday: Boeing (BA), General Dynamics (GD), Spirit Airlines (SAVE), International Business Machines (IBM), Mattel (MAT), Meta (META), O’Reilly Automotive (ORLY)

●Thursday: (BMY), Bristol-Myers Squibb (BMY), Caterpillar (CAT), Eagle Materials (EXP), Hershey (HSY), Keurig Dr. Pepper (KDP), Southwest Airlines (LUV), Mastercard (MA), Merck (MRK), Newmont (NEM), United Parcel Service (UPS), Amazon (AMZN), Ford (F), First Solar (FSLR), Intel (INTC), Boston Beer (SAM), Verisign (VRSN), United States Steel (X)

●Friday: AbbVie (ABBV), AutoNation (AN), Aon (AON), Phillips 66 (PSX), Exxon Mobil (XOM)

This week’s numbers include the first look at Q3 GDP, durable goods orders, and the Fed’s preferred inflation gauge, the PCE Price Index:

●Monday: Chicago Fed National Activity Index

●Tuesday: S&P Case-Shiller Home Price Index, S&P Global Manufacturing and Services PMIs (flash)

●Wednesday: New Home Sales

●Thursday: GDP (Q3, initial estimate), Durable Goods Orders, Advance Retail and Wholesale Inventories, Pending Home Sales

●Friday: Personal Income and Spending, PCE Price Index, Consumer Sentiment

Check the Active Trader Commentary each morning for an updated list of earnings announcements, IPOs, economic reports, and other market events.

The VIX disposition

Last week we noted the Cboe Volatility Index (VIX) closed higher for the week ending October 13 even though the SPX did, too—a possible sign the options market was anticipating more volatility even though stocks were rising. Last week made good on the VIX’s “forecast.”

As of Friday, though, the market and the VIX were back in sync: The SPX closed sharply lower for the week (testing the four-month low it set in early October) and the VIX responded with its highest close since March.

Click here to log on to your account or learn more about E*TRADE's trading platforms, or follow the Company on Twitter, @ETRADE, for useful trading and investing insights.