Going vertical

- Gaming platform SKLZ up more than 20% after 71% correction

- Stock sold off Wednesday after earnings

- Vertical spreads can help traders establish targeted near-term

One of the reasons traders combine options in spread strategies is to construct positions with a little more nuance or “wiggle room” than outright options or stock trades.

But as in all aspects of trading, that potential advantage comes with a price.

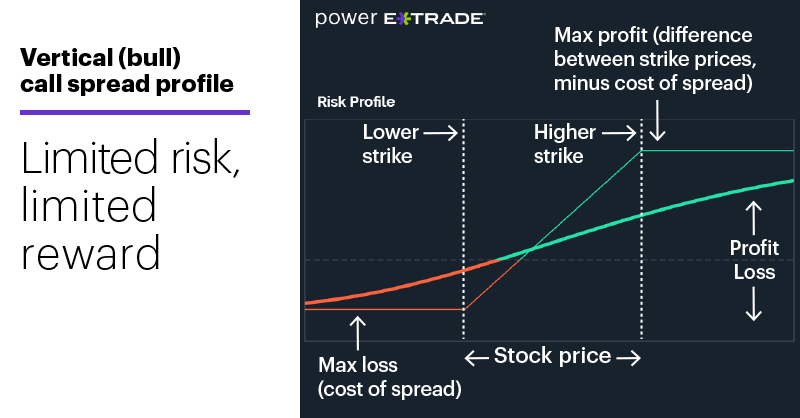

For example, one of the most basic bullish options strategies is the vertical call spread, which consists of a long call option (often with at-the-money strike price) and a short call option with a higher (out-of-the-money) strike price. The following chart shows the strategy’s risk–reward profile:

Source: Power E*TRADE

The addition of the short call option puts a simple twist on the straight long-call trade: It reduces the cost of putting on a bullish position because the trader gets to keep the premium collected from selling the higher-strike call, regardless of what happens.

So, why wouldn’t traders always use a vertical call spread instead of simply buying calls? As the risk profile shows, just as the short call reduces the position’s cost—in other words, its risk, since the maximum loss is the cost of the spread, no matter how far the stock falls—it also caps its potential reward, since gains stop increasing even if the stock keeps rallying past the higher strike price.

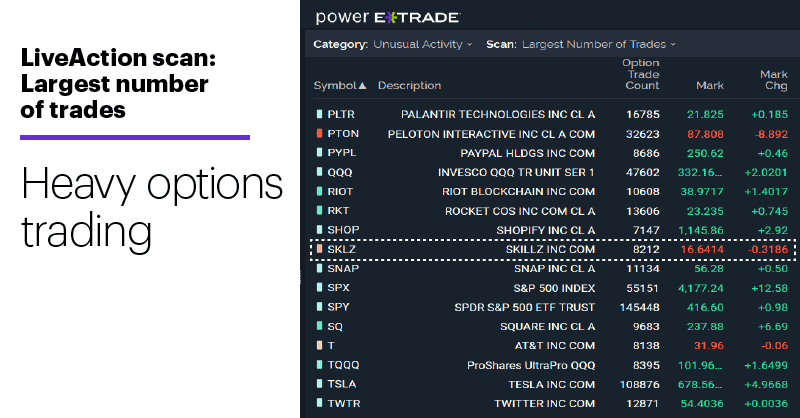

Because of this tradeoff, some traders will use vertical spreads when they think a stock has the potential to make a limited move in the relatively near future (as opposed to a longer-term, open-ended gain). Activity in gaming stock Skillz (SKLZ), which appeared on yesterday’s LiveAction scan for heavy options trading, helps illustrate the basic idea:

Source: Power E*TRADE

Wednesday’s heavy trading in SKLZ followed its earnings release, which included an earnings miss, a revenue beat, and raised forward guidance.1 (This is only the company’s second earnings release; Skillz officially began trading last December after a SPAC reverse merger.)

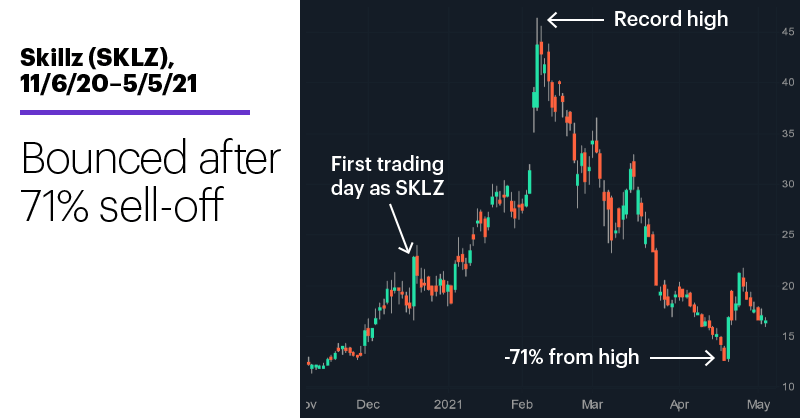

Shares tumbled more than 9% intraday, but as the following chart shows, the big-picture story is that this news came as the stock was still attempting to rebound off its April low of $12.55 after a 71% slide from its all-time high of $43.72 in December. Even after giving back more than half of its initial bounce, SKLZ was still up more than 20% from its April 20 close:

Source: Power E*TRADE

In this type of situation, bullish traders who felt a stock was still oversold (or who were waiting for it to test a recent low) may look into using a vertical call spread to play a potential near-term rebound they felt was more likely than, say, an extended rally to a new all-time high.

Different strategies for different time frames and goals.

Futures Watch: July lumber (LBSN1) and July corn (ZCN1) continued to pace the commodities rally—both markets hit new contract highs yesterday.

Today’s numbers include (all times ET): Weekly jobless claims (8:30 a.m.), Productivity and Costs (8:30 a.m.).

Today’s earnings include: Tapestry (TPR), Beyond Meat (BYND), Kellogg (K), US Concrete (USCR), Carvana (CVNA), Dropbox (DBX), Epam Systems (EPAM), Penn National Gaming (PENN), Moderna (MRNA), Square (SQ), Roku (ROKU).

Today’s IPOs include: Bowman Consulting Group (BWMN).

Click here to log on to your account or learn more about E*TRADE's trading platforms, or follow the Company on Twitter, @ETRADE, for useful trading and investing insights.

1 StreetInsider.com. Skillz (SKLZ) Misses Q1 EPS by 5c, Revs Beat; Raises Outlook. 5/4/21.