How asset allocation may help you reach your goals faster

E*TRADE Securities

07/07/23Summary: Asset allocation is how you choose to divvy up various assets within your portfolio, like stocks, bonds, and cash. Here’s a breakdown of how it works.

Asset allocation made simple

When it comes to building a portfolio, it’s important to keep two key concepts in mind:

- Diversification: Having different types of securities (such as stocks and bonds) in your portfolio

- Asset allocation: The share of your portfolio that you invest in each type of security

The logic behind it: Most investments don’t move in the same direction at the same time. In periods of economic uncertainty, for example, stocks tend to fluctuate in value while bonds and other fixed-income investments are known to hold their value.

If you hold different types of investments (hopefully complementary ones) in your portfolio, your winners and losers may balance each other out, resulting in less volatility within your portfolio and–ideally–minimizing potential losses over time. The goal of asset allocation is to keep your money safe while also allowing it to grow.

To illustrate this idea, let’s use a metaphor:

Think of your portfolio like a car

In this metaphor, your stocks are the fuel that helps your car go, moving forward to reach its destination. When you’re on open road, having the right fuel in your car can propel the vehicle smoothly forward while you sit back and enjoy the ride. But what happens when there is traffic or potholes in the road? If you hit a roadblock or detour? You may need a bit more than fuel to get your car to a safe destination.

Handling bumps in the road

If stocks are the fuel for your car, then bonds and other fixed income investments are your shock absorbers, making the ride much smoother and ensuring that you make it over the rough patches in the road. By mixing bonds into your portfolio, you may have a better chance of making it to your destination on time and with potentially less risk.

You can think of cash as the car’s steering wheel. When the road curves, you can use your steering wheel to make sure you’re able to follow it. The steering wheel also allows you to make a sharp turn when necessary if you unexpectedly come across a road hazard. Having cash in your portfolio allows you to take advantage of opportunities when they arise and avoid potential pitfalls.

Just as a racecar will take different fuel and have different components than an offroad vehicle meant scale rocky terrain, every portfolio may have different needs when it comes to asset allocation. The right mix of stocks, bonds, and cash depends on your specific financial circumstances.

Different investments play different roles in a portfolio

Just as your steering wheel and your shock absorbers have an effect on your car’s ability to reach its destination, different types of investments play different roles for the long-term returns of a portfolio.

Stocks

Stocks are a lot like fuel. When the road is clear and the markets are performing well, holding stocks can provide a meaningful upside.

Bonds

But there may be times you reach roadblock. To help you prepare, you can add bonds to your portfolio—the equivalent of shock absorbers in your car. You may be giving up some gains, but you may also be building up protection in case stocks fall. This is because fixed income, often in the form of bonds, is known to build wealth, add diversification, and manage risk.

Cash

A third portfolio component—cash—is a lot like the steering wheel. Cash usually doesn’t have as high a return as stocks or bonds, but it can be reliable in a variety of market conditions and give you flexibility to take advantage of opportunities, such as purchasing stocks that have declined in value. Point of caution, though: In some circumstances, having too much cash—or steering your car too aggressively—can serve as a drag on your portfolio’s overall return. That’s because cash can lose value over time due to inflation.

As with most things, moderation is key. While diversification may not always protect investors against losses, a balanced portfolio with these three types of investments may be more insulated from risk and less impacted by market volatility.

Asset allocation: Putting all the pieces together

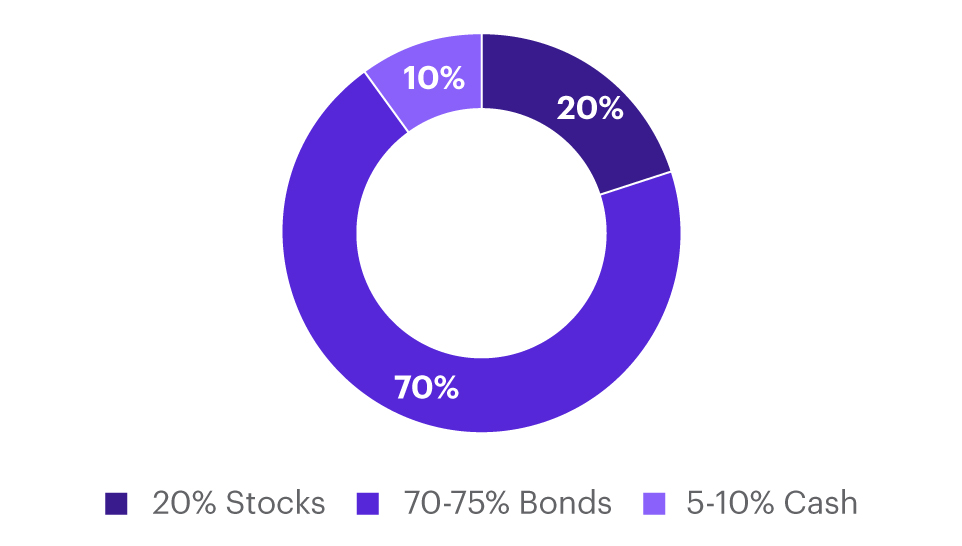

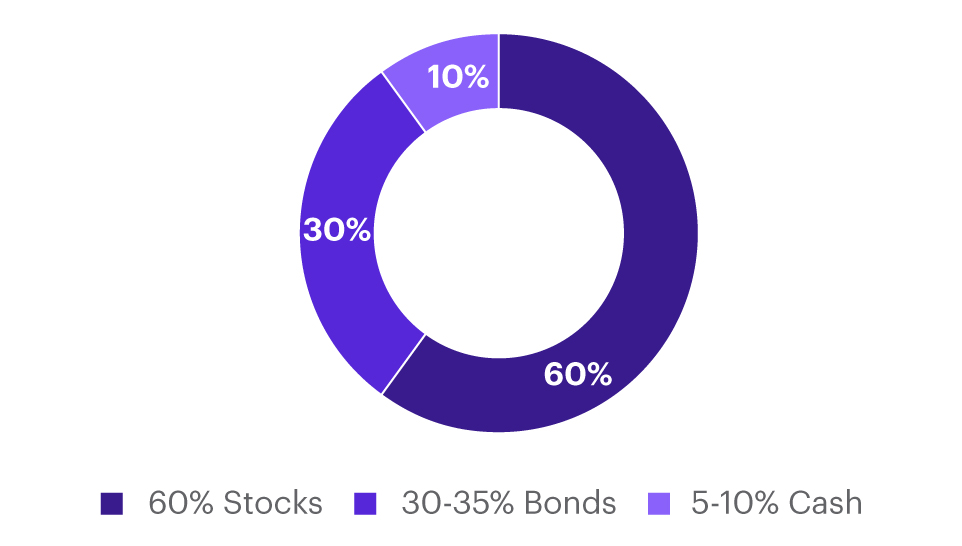

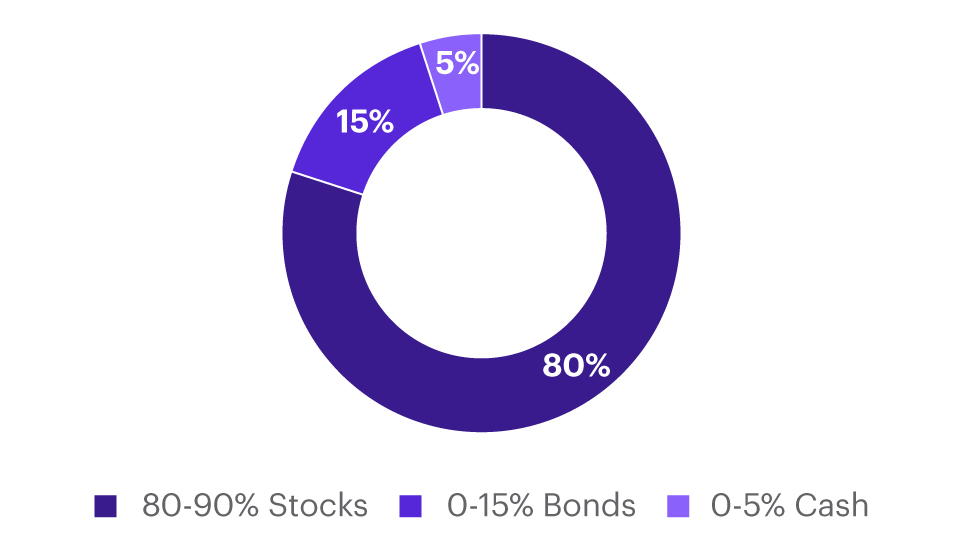

When building a portfolio, the percentage you invest in each category—stocks, bonds, and cash—is commonly referred to as asset allocation. Different combinations of these categories have risk profiles that range from conservative (building in a lot of protection for traffic jams) to aggressive (designed to try to take as much advantage of the road as possible. Some popular examples of asset allocations include:

For illustrative purposes only

How to determine an asset allocation that reflects your goals can depend on several factors, including your investing timeframe, risk tolerance, financial goals, and life situations. It’s important to weigh these considerations carefully—just like you would put on your seatbelt before starting the engine—before putting your portfolio in motion.

How can E*TRADE from Morgan Stanley help?

Brokerage account

Investing and trading account

Buy and sell stocks, ETFs, mutual funds, options, bonds, and more.

Prebuilt Portfolios

Select your risk tolerance and easily invest in diversified, professionally selected portfolios of mutual funds or exchange-traded funds (ETFs). And you pay no trading commissions although fund fees and expenses still apply.

Get started with as little as $500 (mutual funds) or $2,500 (ETFs).

Bonds

Gain direct access to more than 50,000 bonds and fixed income products from issuers of every kind.

All-Star funds

Choose from a list of exchange-traded funds or mutual funds selected by Morgan Stanley Smith Barney LLC.