Options

Intuitive tools with great service and value

- Among the lowest options contract fees in the market

- Easy-to-use platform and app for trading options on stocks, indexes, and futures

- Support from knowledgeable Options Specialists

- Close short options positions priced at 10¢ or less with no contract fee

50¢ equity and index options

per contract when you place 30+ stock, ETF or options trades per quarter2

$1.50 futures options

per contract3

Get up to $1,000 for a limited time1

Open and fund a new brokerage account with a qualifying deposit by January 31, 2025. Learn how

Terms apply. Use promo code: OFFER24

Award winning options trading tools4

Whether you're in-the-money, or out-of-the-money, we'll help you keep on top of your money with intuitive tools for trading options on stocks, indexes, and futures.

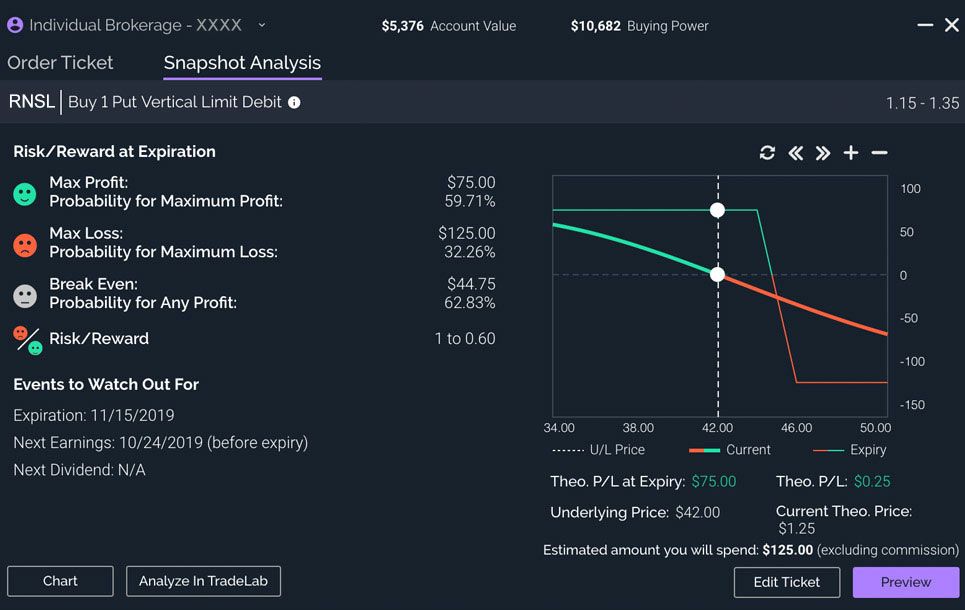

Understand the risk/reward probabilities of an option trade with Snapshot Analysis.

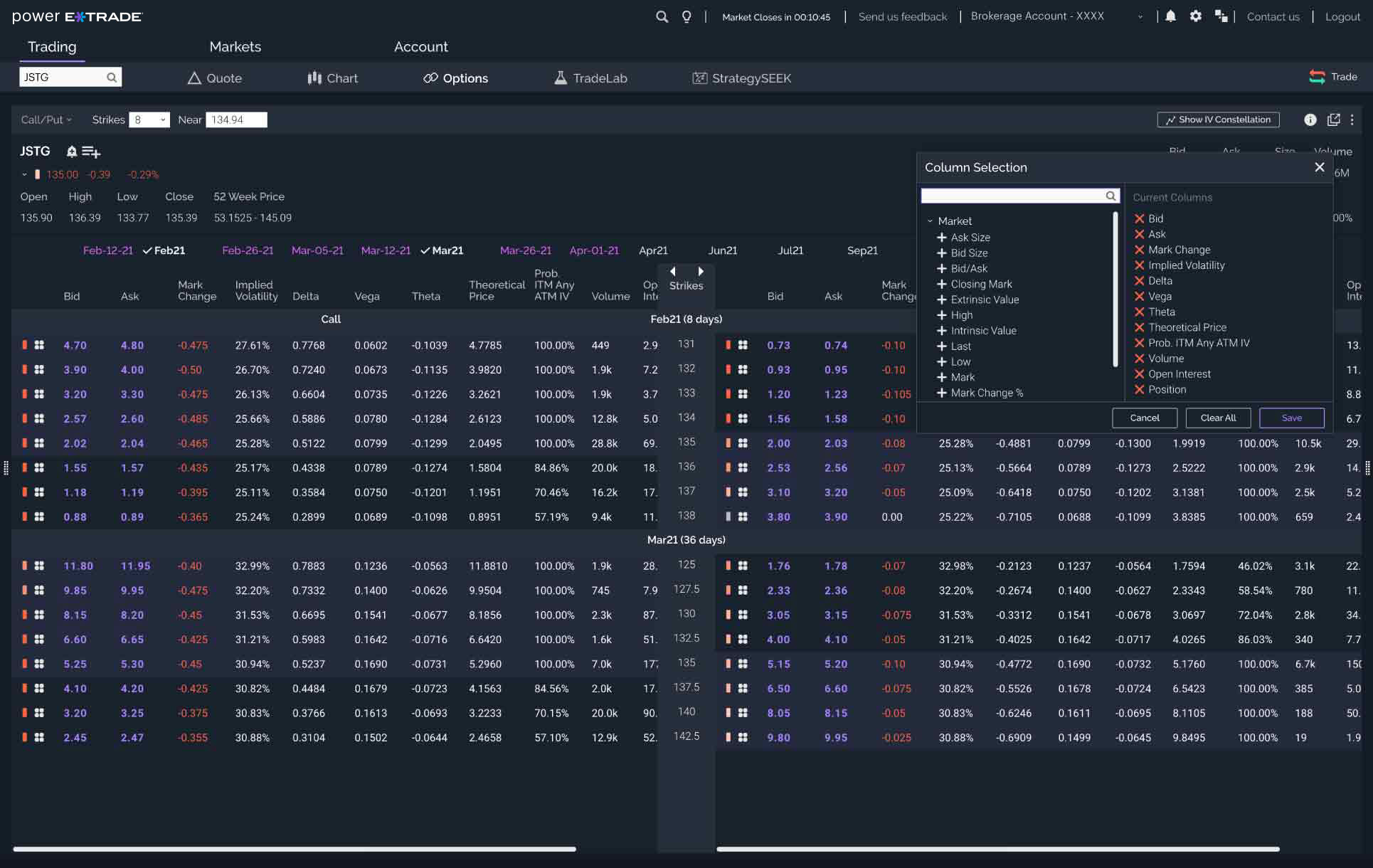

Customize option chain views by spread strategies, width, strikes and dollar value.

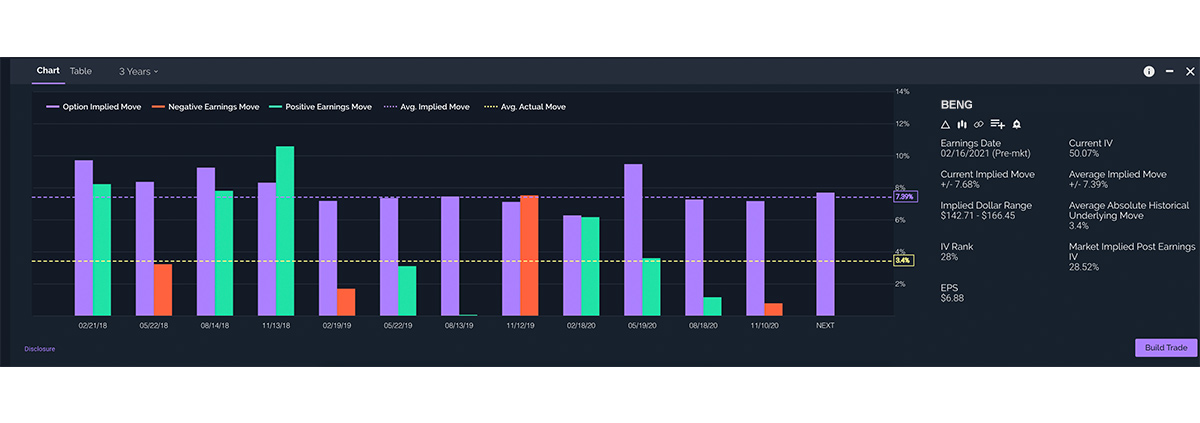

View a stocks’ expected price move, average implied move, and average historical move. Select a strategy and enter your earnings move order directly from the tool.

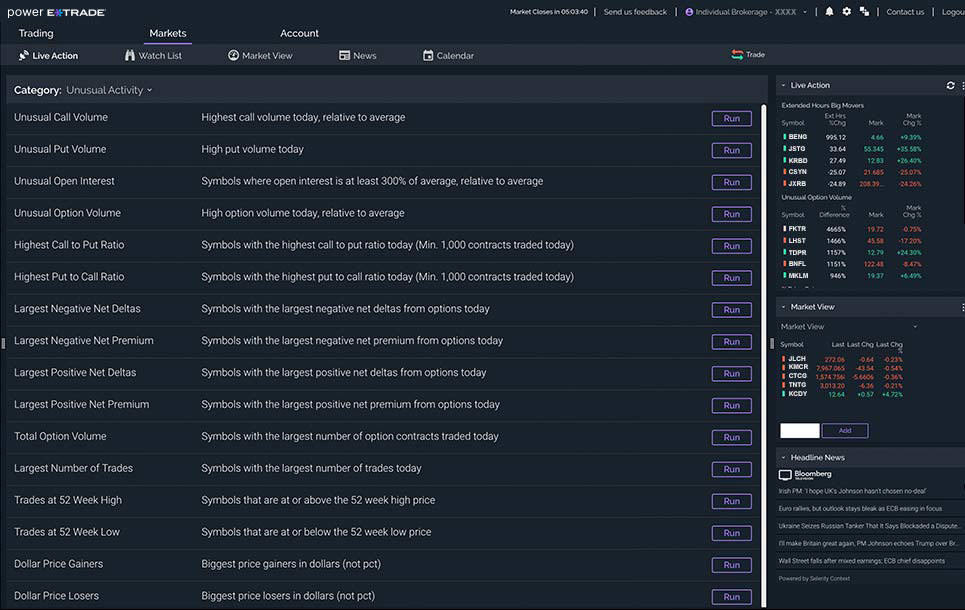

Spot opportunities with Live Action real time scans for unusual activity, volatility and technical indicators.

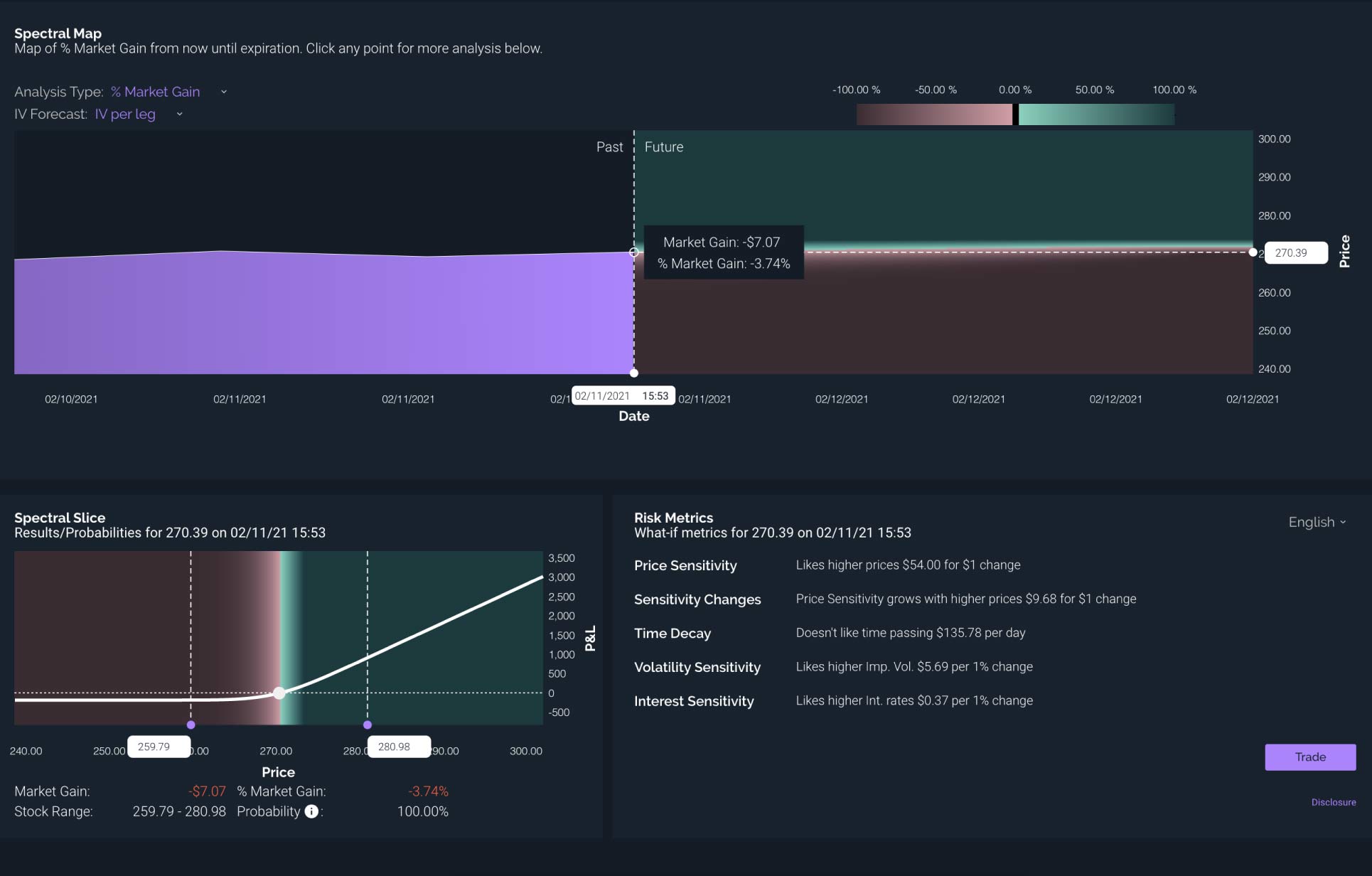

Explore “what if” scenarios of an options strategy and understand the risk metrics in plain English.

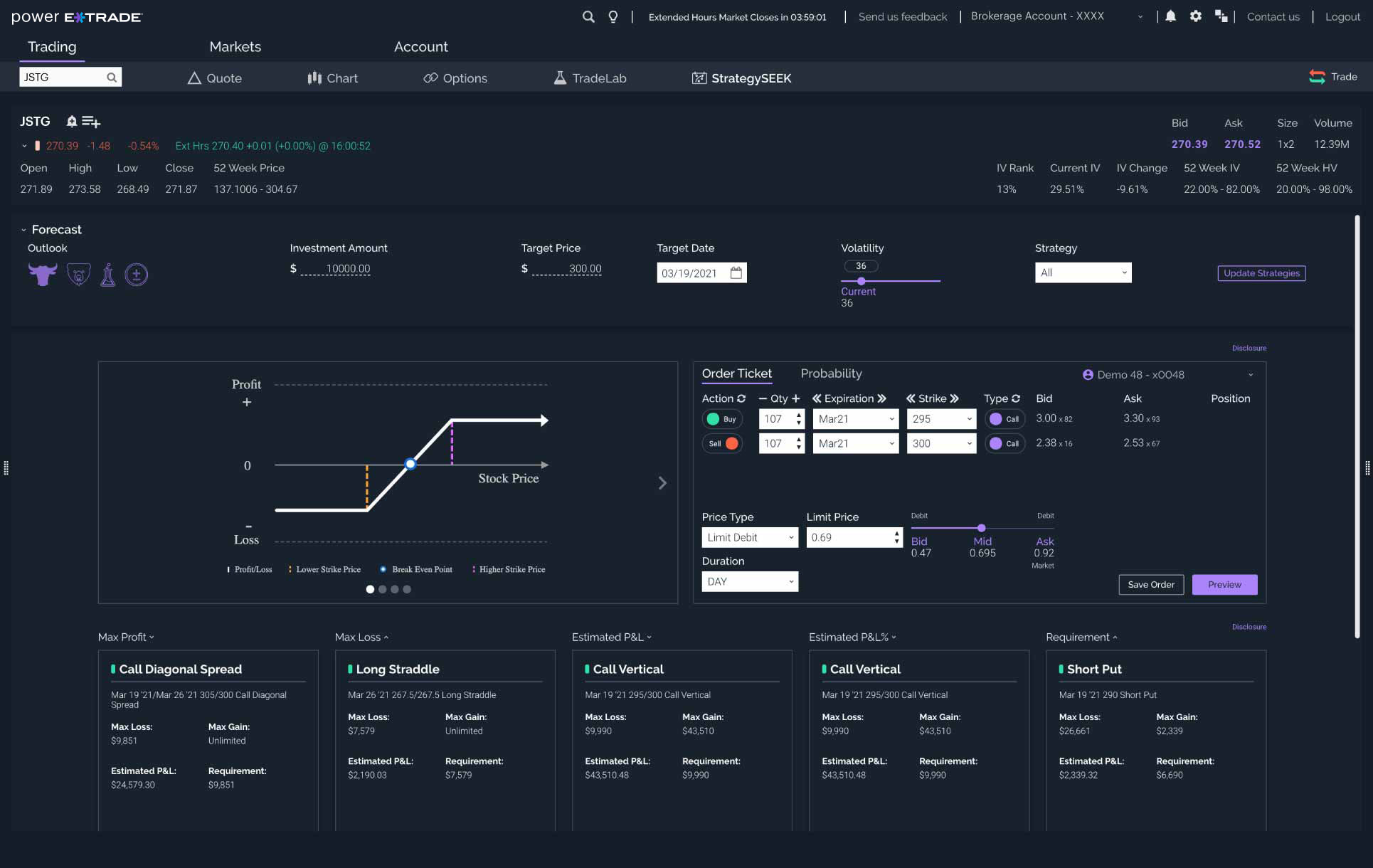

Scan for option trades that fit your criteria based on target price, date, and investment.

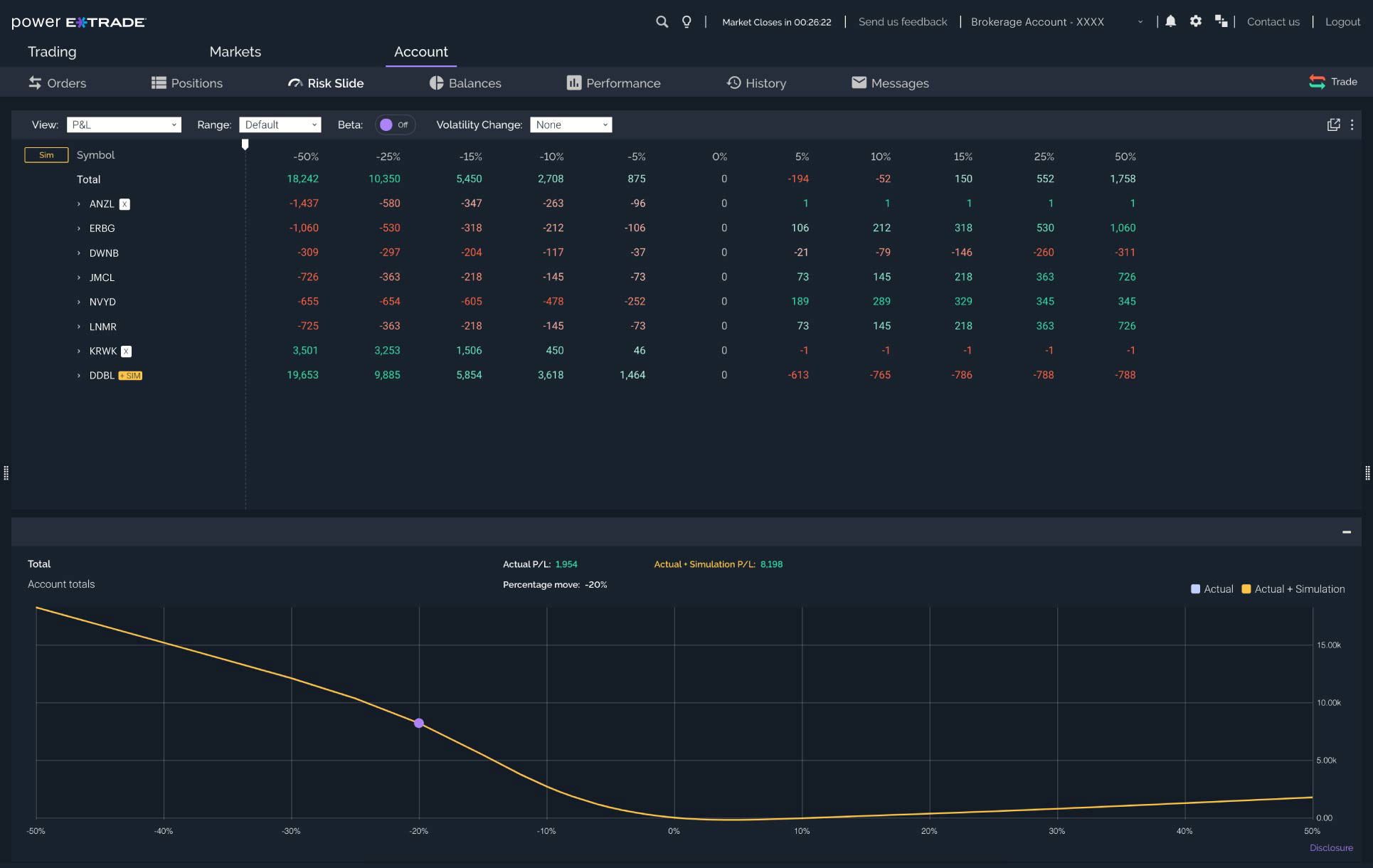

Visualize the risk of your portfolio in the event of a significant market move, including expected profit and loss compared to the S&P 500 Index and simulate your strategy.

Dime Buyback Program

Pay no per-contract charge when you buy to close an equity option priced at 10¢ or less. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees.5

Discover options on futures

Options on futures offer nearly 24-hour access6 to react around potentially market moving economic events. Hedge existing futures positions, earn premium or speculate while using less money upfront. Plus, diversify into metals, energies, currencies and more.

Options Pricing

Pricing |

Preferred 30+ Trades / QTR |

Standard <30 Trades / QTR |

|---|---|---|

| Equity and Index Options | $0.50 per contract $0 base |

$0.65 per contract $0 base |

| Futures Options |

$1.50 per contract | $1.50 per contract |

Options Levels

Add options trading to an existing brokerage account. Apply now keyboard_arrow_right

| Level 1 | Level 2 | Level 3 | Level 4 | |

|---|---|---|---|---|

| Option Investment Objective | Income, Aggressive Income, Capital Appreciation, Speculation |

Aggressive Income, Capital Appreciation, Speculation |

Capital Appreciation or Speculation |

Speculation |

| Options strategies available | Covered positions

|

All Level 1 strategies, plus:

|

All Level 1 and 2 strategies, plus:

|

All Level 1, 2, and 3 strategies, plus:

|

*Margin approval is required for Levels 3 and 4.

Options involve risk and are not suitable for all investors. For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Commissions and other costs may be a significant factor. An options investor may lose the entire amount of their investment in a relatively short period of time.

Learn more about options

Our knowledge section has info to get you up to speed and keep you there.

Why trade options?

Three common mistakes options traders make

Understanding options Greeks

Dedicated support for options traders

Have platform questions? Want to discuss complex trading strategies? Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading.

Call us at 800-387-2331 (800-ETRADE-1)

Get up to $1,000 for a limited time1

Open and fund a new brokerage account with a qualifying deposit by January 31, 2025. Learn how

Terms apply. Use promo code: OFFER24