Refresh February 07, 2026 7:10 AM ET

Refresh February 07, 2026 7:10 AM ET

Apply for an options account Already a brokerage customer?

|

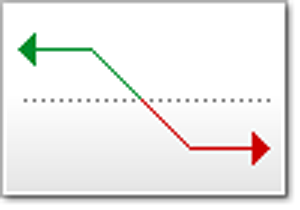

A Bear Call Spread is a bearish strategy involving one long call and one short call where the short call strike price is lower than the long call strike price. Expirations are equal for this strategy. The strategy results in a net premium received (credit) upon initial order entry.

Uses Option traders use this strategy when they want to profit from a decline in the price of the underlying security. Risks This strategy is considered to have limited risk and limited reward. The maximum gain is limited to the amount of net premium received. The maximum loss is the difference in strike prices minus the net premium received. Adverse price movement is the largest risk associated with this strategy and should be the primary focus of the option trader. Volatility changes tend to have a neutral impact on this type of strategy because of the offsetting positions. All other things being equal, small changes in volatility due to price movement could adversely affect this strategy, but are secondary risks to the price movement itself. Time decay has a neutral to favorable impact on this strategy due to the offsetting positions. Options traders have an increased amount of assignment risk on this trade. Early assignment (American Style) on the short strike price could occur, especially when the strike price is in-the-money and there is an approaching "ex-date" for a dividend payment. Also, assignment at expiration could result in only the short leg being assigned. This has the potential to leave the option trader exposed on an underlying position. When these risks are a concern, the best course of action may be to close the strategy prior to potential assignment or expiration.

Important Note: Options involve risk and are not suitable for all investors. For more information, please read the Characteristics and Risks of Standardized Options. |

Back to Top

Back to Top